Project Planning Investment in Energy Storage: A 2025 Guide for

As of 2025, global energy storage capacity is exploding faster than a lithium battery in a microwave, with China alone boasting 44.44GW of operational projects [1]. But before you

Get a quote

How to Finance Energy Storage Projects

This guide explores the key strategies and options for securing energy storage financing, helping project owners and sponsors navigate the financial

Get a quote

Energy Storage Project Finance Guide

Energy storage projects require significant upfront investment, and the choice of financial structure can have a significant impact on the project''s viability and returns.

Get a quote

What does the energy storage investment process include?

For instance, evaluating local utility needs or assessing whether commercial entities have ongoing projects that require additional energy resilience can drive the development of a

Get a quote

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get a quote

Energy Storage Financing

rage project investment. This is the fifth study in the Energy Storage Financing Study series, which is designed to investigate challenges surrounding the financing of energy storage

Get a quote

Shell Energy Storage and Battery Initiatives for 2025: Key Projects

Explore Shell''s strategic investments and partnerships driving the energy transition. Learn about their advancements in renewable energy and energy storage solutions.

Get a quote

Cost Analysis for Energy Storage: A Comprehensive

Discover essential trends in cost analysis for energy storage technologies, highlighting their significance in today''s energy landscape.

Get a quote

Financial Investment Valuation Models for

From a financial viewpoint, renewable energy production projects withstand significant challenges such as competition, irreversibility of

Get a quote

What does investing in energy storage include? | NenPower

Investing in energy storage entails 1. capital allocation in diverse technologies, 2. understanding regulatory frameworks and market dynamics, 3. evaluating performance and

Get a quote

Making project finance work for battery energy storage projects

A key element of this template is a project management framework that is replicable for other projects, which is in contrast to the traditional approach to energy storage projects, which has

Get a quote

State-by-State Overview: Navigating the Contemporary U.S. Energy

Regulatory adaption is another key component of energy storage policy, involving changes to state energy regulations that create opportunities for storage. All states with a

Get a quote

Energy Storage Investments – Publications

Key diligence areas when considering energy storage projects include evaluating the battery technology as well as the supplier and country of origin of the batteries and other

Get a quote

What does indoor energy storage project include? | NenPower

Indoor energy storage projects encompass various elements crucial for efficient power management and sustainability. 1. Key components include batteries, which serve as

Get a quote

What does the energy storage investment process include?

The investment process in energy storage encompasses several crucial phases designed to facilitate financial viability and operational effectiveness. 1. Project identification

Get a quote

Energy Storage Best Practice Guide: Guidance for Project

This Energy Storage Best Practice Guide (Guide or BPGs) covers eight key aspect areas of an energy storage project proposal, including Project Development, Engineering,

Get a quote

How to Finance Energy Storage Projects

This guide explores the key strategies and options for securing energy storage financing, helping project owners and sponsors navigate the financial landscape effectively.

Get a quote

ENERGY STORAGE – FOLLOW THE MON

PROJECT FINANCING CHALLENGES As the industry ramps up its development and construction of energy storage systems, there is increased demand from developers to finance

Get a quote

Evaluating the Value of Long-Duration Energy Storage in

ABSTRACT Energy storage will play an increasingly important role in California''s transitioning energy system. Specifically, long-duration storage (storage with a duration of eight or more

Get a quote

Cost Analysis for Energy Storage: A Comprehensive Step-by

Discover essential trends in cost analysis for energy storage technologies, highlighting their significance in today''s energy landscape.

Get a quote

ENERGY STORAGE PROJECTS

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors,

Get a quote

Key Capture Energy Completes Construction and ITC

New Projects Expand Key Capture Energy''s Operating Portfolio to Over 620MW Albany, NY – January 7, 2025 – Key Capture Energy, LLC ("KCE"), a leading

Get a quote

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

6 FAQs about [Key points for energy storage project investment include]

Are energy storage projects a good investment?

Investors and lenders are eager to enter into the energy storage market. In many ways, energy storage projects are no different than a typical project finance transaction. Project finance is an exercise in risk allocation. Financings will not close until all risks have been catalogued and covered.

What is the energy storage project?

The Gilboa pumped storage power plant is an energy storage project that involves constructing a power plant to pump water from a low-level reservoir to a high-level reservoir, with a height difference of 574 meters. This environmentally friendly plant complements the unique landscape of the North of Israel.

What is energy storage?

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

How will energy storage help a net-zero economy by 2050?

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors, energy storage will play a key role in the shift to a net-zero economy by 2050.

Why is energy storage important?

Energy storage serves important grid functions, including time-shifting energy across hours, days, weeks, or months; regulating grid frequency; and ensuring flexibility to balance supply and demand.

Can LPO finance energy storage projects?

LPO can finance short and long duration energy storage projects to increase flexibility, stability, resilience, and reliability on a renewables-heavy grid. Why Energy Storage?

Guess what you want to know

-

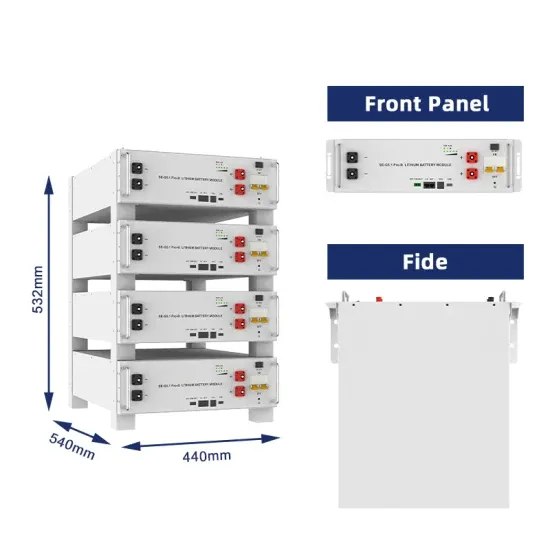

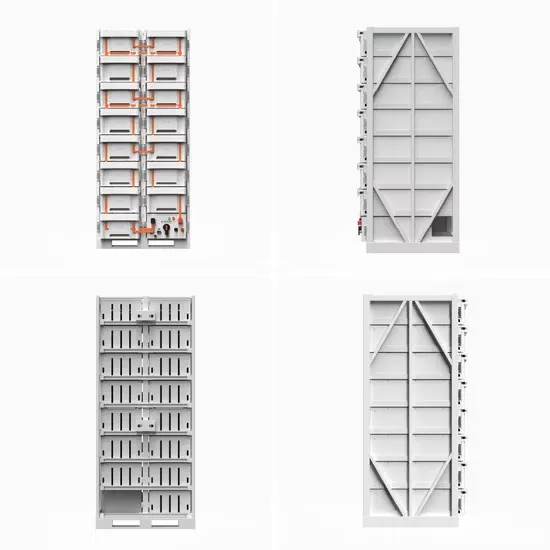

Key points in energy storage product design

Key points in energy storage product design

-

Island investment energy storage power station project

Island investment energy storage power station project

-

Mobile energy storage equipment investment project

Mobile energy storage equipment investment project

-

Niger energy storage battery project investment

Niger energy storage battery project investment

-

Uganda Photovoltaic Energy Storage Investment Project

Uganda Photovoltaic Energy Storage Investment Project

-

Small investment energy storage project

Small investment energy storage project

-

Myanmar lithium battery energy storage investment project

Myanmar lithium battery energy storage investment project

-

Key points for purchasing energy storage lithium batteries

Key points for purchasing energy storage lithium batteries

-

Indonesia Energy Storage Project Investment

Indonesia Energy Storage Project Investment

-

Key Points for Using Energy Storage Equipment

Key Points for Using Energy Storage Equipment

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.