Snapshot of Global PV Markets

After several years of tension on material and transport costs, module prices plummeted in a massively over-supplied market, maintaining the competitivity of PV even as electricity prices

Get a quote

Global solar PV supply chain

In that last year, the global solar PV chain reached an industrial business value of some 104.7 billion U.S. dollars, with China dominating the market, and followed by the United

Get a quote

Current state of China''s photovoltaic inverter industry

This article will discuss current state of China''s PV inverter industry, including industrial chain structure, policy support, market size,

Get a quote

Global PV module manufacturing to reach 1.8TW in 2025 – report

Solar supply chain in China increased by 29% in 2024. Image: Avaada Group. Australian thinktank Climate Energy Finance (CEF) has forecast global solar module

Get a quote

Solar PV Module Market Size, Growth Outlook 2024 -2032

Likewise, China and the US have solidified their positions as leaders in the global solar PV module landscape. The two countries,

Get a quote

Solar PV Module Market Size, Growth Outlook 2024 -2032

The global solar PV module market size was valued at USD 280.5 billion in 2023 and is set to grow at a CAGR of over 8.2% between 2024 and 2032. It is a system that converts sunlight

Get a quote

Solar Supply Chain and Industry Analysis | Solar Market

NREL conducts detailed supply chain analysis for specific photovoltaic module technologies. These analyses include production locations, supply chain risk and costs, and

Get a quote

Solar and storage 2025: US policy risks and the new global market

Although AD/CVD duties continue to fluctuate, PV module exports from the four Southeast Asian countries—Vietnam, Malaysia, Thailand, and Cambodia—to the U.S. have

Get a quote

Solar PV Module Market Trends, Share and Forecast,

The solar PV module market is expected to grow significantly over the next decade driven by supportive government policies and regulations

Get a quote

India''s PV module production capacity hits 64.5 GW,

Mercom says in a new report that India installed 20.8 GW of solar module manufacturing capacity and 3.2 GW of new PV cell production lines in

Get a quote

Global solar PV supply chain

Export value of solar PV modules worldwide 2024, by country Export value of solar photovoltaic modules worldwide in 2024, by leading country (in million U.S. dollars)

Get a quote

How to Analyze the Current Status of Photovoltaic Module Exports

Understanding the dynamics of photovoltaic (PV) module exports is critical for manufacturers, traders, and policymakers navigating the fast-evolving solar energy sector. This article breaks

Get a quote

Solar Capacity in India: Annual India Solar Report

Annual Market shares- FY2024 Modules: Jinko, Longi, and Trina were the top three module suppliers in India in FY2024. The Chinese/ International players''

Get a quote

Executive summary – Solar PV Global Supply Chains

Today, China''s share in all the manufacturing stages of solar panels (such as polysilicon, ingots, wafers, cells and modules) exceeds 80%. This is more than double China''s share of global PV

Get a quote

The State of the Solar Industry

Analysts estimate 2023 global installations reached around 440 GWdc, an 89% increase over 2022 installations, bringing cumulative global capacity to approximately 1.6 TWdc. A significant

Get a quote

Global PV Module Market Analysis and 2025 Outlook

PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

Get a quote

The trend of "volume increase and price decrease" in PV module

From the country distribution point of view, the Netherlands, Brazil, Saudi Arabia and other countries continue to lead the PV module export market, in May the export volume

Get a quote

Snapshot of Global PV Markets

High electricity market prices have reinforced the competitivity of PV and several countries have acted policies to further accelerate PV in line with EU and national energy sovereignty

Get a quote

China Exported 206 GW Solar Modules During 10M 2024

As the demand for solar PV grows globally, China – the world''s largest solar PV factory – continues to remain busy rolling out products across the supply chain to meet this

Get a quote

Solar and storage 2025: US policy risks and the new global

Although AD/CVD duties continue to fluctuate, PV module exports from the four Southeast Asian countries—Vietnam, Malaysia, Thailand, and Cambodia—to the U.S. have

Get a quote

Annual India Solar Report Card – CY2024

Annual Market shares- CY2024 Modules: Waaree, Jinko and Longi were the top three module suppliers in India in CY2024. Chinese and international players'' solar PV module

Get a quote

The trend of "volume increase and price decrease" in PV module exports

From the country distribution point of view, the Netherlands, Brazil, Saudi Arabia and other countries continue to lead the PV module export market, in May the export volume

Get a quote

Global Photovoltaic Module Export Market Trends Challenges

Current State of the Photovoltaic Module Export Market Solar panel exports grew by 34% year-over-year in 2023, with Asia dominating 78% of global shipments. The push toward carbon

Get a quote

Solar PV module market outlook 2025: emerging trends and market

Likewise, China and the US have solidified their positions as leaders in the global solar PV module landscape. The two countries, respectively, are expected to reach $104.79bn

Get a quote

Solar PV Module Market Trends, Share and Forecast, 2025-2032

The solar PV module market is expected to grow significantly over the next decade driven by supportive government policies and regulations across major markets.

Get a quote

India PV Module Intelligence Brief | Q1 2024

Recent reports India PV Module Intelligence Brief | Q1 2025 This report encapsulates quarterly trends in module demand and supply, import

Get a quote

Guess what you want to know

-

Andorra monocrystalline solar photovoltaic module export tariffs

Andorra monocrystalline solar photovoltaic module export tariffs

-

Export photovoltaic module sales

Export photovoltaic module sales

-

Photovoltaic module export enterprises

Photovoltaic module export enterprises

-

Philippines photovoltaic module export tariffs

Philippines photovoltaic module export tariffs

-

Japanese photovoltaic module export company

Japanese photovoltaic module export company

-

Photovoltaic module export channels

Photovoltaic module export channels

-

Price of one megawatt photovoltaic module

Price of one megawatt photovoltaic module

-

Thin-film photovoltaic module production

Thin-film photovoltaic module production

-

Photovoltaic module battery types

Photovoltaic module battery types

-

270wp photovoltaic module price

270wp photovoltaic module price

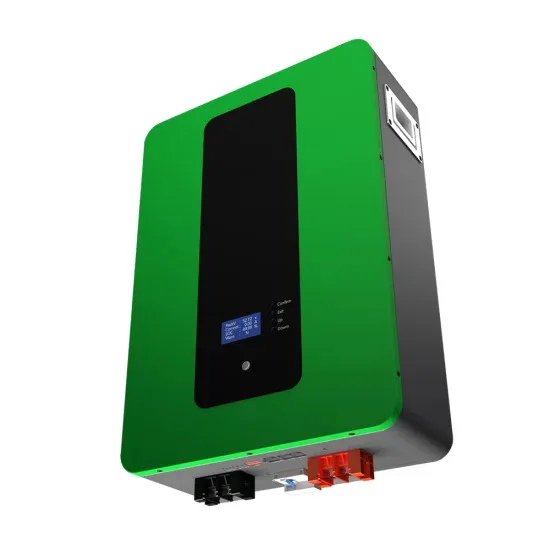

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

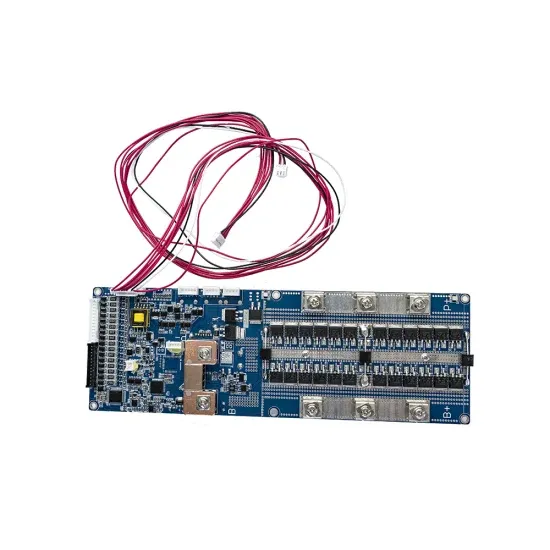

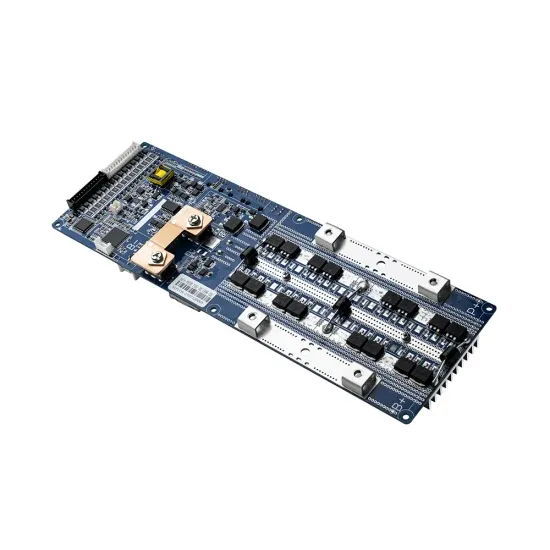

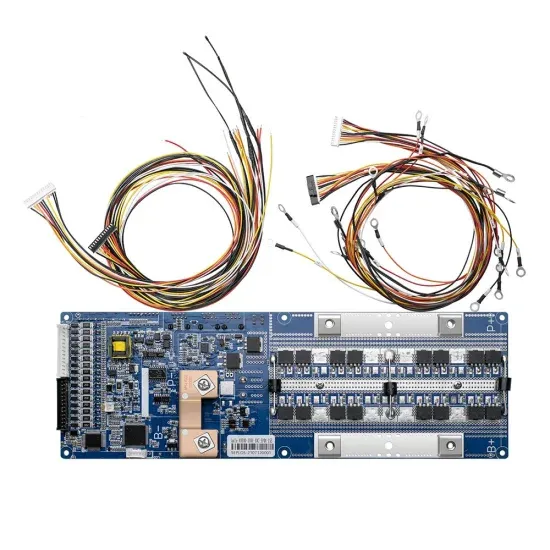

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.