ENERGY-HUB

ENERGY-HUB is a modern independent platform sharing news and analytic articles from the energy sector on a daily basis. Within our portfolio we monitor czech, slovak and foreign press

Get a quote

Germany energy storage news roundup: Tesvolt,

Image: Tesvolt corporate video. An energy storage news roundup from Germany, including 10MWh-plus projects from Tesvolt and Wirsol Roof

Get a quote

Overcoming the Obstacles in the German Energy Storage Sector

As the German energy storage market expands, recruiting the right talent becomes increasingly crucial. Our role as a recruitment firm is to connect renewable

Get a quote

Germany Household Storage Container Market Benchmarks

Germany''s household storage container market is projected to grow steadily through 2033, driven by heightened urbanization and space optimization needs in metropolitan

Get a quote

Germany plans long-duration energy storage auctions for 2025

German government opens public consultation on new frameworks to procure energy resources, including long-duration energy storage (LDES).

Get a quote

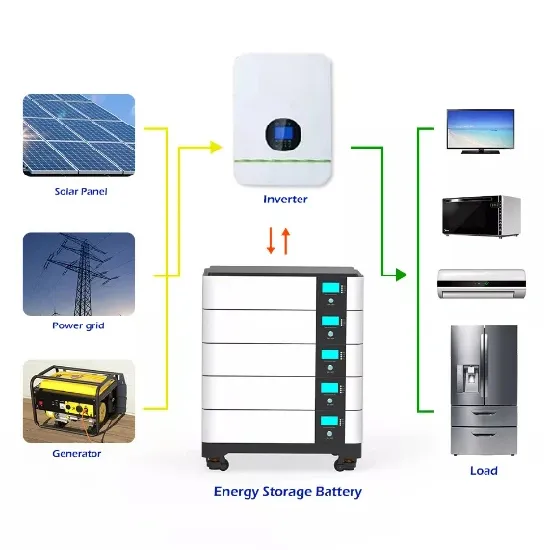

Energy Storage Systems For Renewable Energies

TESVOLT, a leading European full-service provider of innovative energy storage solutions for public utilities and commerce, is collaborating with Samsung SDI

Get a quote

Energy storage in Germany – what you should know

In order to obtain such permit, the battery storage system must comply with the applicable planning and building law. Power to gas/liquid systems usually require a permit under the

Get a quote

Reducing battery procurement risk for US energy

In the rapidly growing battery energy storage sector, equipment procurement and integration for large projects presents numerous risks.

Get a quote

Electricity Storage Strategy

Electricity storage has an important role to play in this, both for energy storage as such and also for the stabilisation of the electricity system and the grids. Currently, a strong and market

Get a quote

Who are the German container energy storage suppliers

Energy storage - Germany Germany. 42 Companies 54 Products We are also currently in the certification phase of residential and industrial energy cabinets as well as energy storage

Get a quote

German energy storage container installation

What type of energy storage is used in Germany? According to data from TrendForce, energy storage in Germany is mainly focused on residential storage, with residential installations

Get a quote

Long Duration Energy Storage Council (LDES Council)''s Post

Germany is preparing for its first auctions of long-duration energy storage (LDES) systems, targeting 2025 and 2026. The initiative aims to support the integration of renewable energy into...

Get a quote

90 MW/138 MWh BESS for STEAG utility, Germany

Each BESS was mounted inside a container for easy transportation and installation. The use of Nidec''s innovative battery storage technology not only

Get a quote

German innovation tender four times oversubscribed, 29

The German Federal Network Agency (Bundesnetzagentur) received bids totaling over 2 GW in its latest innovation tender, which is open to renewable energy projects

Get a quote

Germany''s Energy Storage Support Policy: Key Initiatives and

With 80% renewable target by 2030, Germany needs to add 5GW of storage annually – equivalent to building a new Tesla Megapack every 90 minutes! While the collapse

Get a quote

Energy Storage Parts Procurement: A Strategic Guide for Industry

When Procurement Meets Politics: The New Reality The IRA (Inflation Reduction Act) isn''t just about inflation - it''s reshaping energy storage parts procurement like a toddler

Get a quote

The Energy Storage Market in Germany

Energy storage systems are an integral part of Germany''s Energiewende ("Energy Transition") project. While the demand for energy storage is growing across Europe, Germany remains the

Get a quote

Germany: Energy storage strategy — more flexibility and stability

The strategy paper provides an overview of the measures and challenges involved in establishing energy storage systems. The energy storage strategy aims to promote the

Get a quote

Long Duration Energy Storage Council (LDES

Germany is preparing for its first auctions of long-duration energy storage (LDES) systems, targeting 2025 and 2026. The initiative aims to support the

Get a quote

Germany energy storage news roundup: Tesvolt, Wirsol projects

The containers, totalling 4MW of power and 10MWh of energy storage, will connected to a 12MWp solar PV plant in Lower Saxony, northwest Germany. It is the fourth

Get a quote

BW ESS, Zelos partner on 1.5 GW of large-scale

German''ys large-scale battery energy storage system (BESS) expansion continues, with another a new partnership in the gigawatt scale,

Get a quote

Germany Energy Storage Market

Since energy storage systems (ESS) can balance supply and demand, they are an essential part of Germany''s energy transition. In line with this, the market for ESS is constantly growing.

Get a quote

6 FAQs about [German Energy Storage Container Procurement]

Why do we need energy storage systems in Germany?

Increasing the share of renewables poses new challenges: Excess energy produced during off-peak hours needs to be stored and made available when needed. Since energy storage systems (ESS) can balance supply and demand, they are an essential part of Germany’s energy transition. In line with this, the market for ESS is constantly growing.

Is Germany a good place to invest in energy storage?

While the demand for energy storage is growing across Europe, Germany remains the European lead target market and the first choice for companies seeking to enter this fast-developing industry. The country stands out as a unique market, development platform and export hub.

What is the business model for a German energy storage system?

Therefore the business model for a German energy storage system is slightly different to business models in other markets. The key business models in Germany comprise: Improvement of reliability of electricity supply for industrial production.

How much does Germany spend on EV and stationary battery research?

Public research and development incentives for EV and stationary battery research amount to between EUR 80 million and EUR 85 million every year. As the European lead market in the energy transition age, Germany provides the opportunity for companies to develop, test, define and market new energy storage solutions.

Does Germany have a grid-parity for photovoltaic & energy-storage?

In 2018, photovoltaic (PV) and energy-storage for households reached grid-parity: storing PV energy with batteries became cheaper than the price from the public power network. However, the majority of PV systems in Germany are not yet connected to batteries – in 2018 only 8% were equipped accordingly.

How does Germany support the energy transition?

The German population supports the goals of the energy transition. Improved energy self-sufficiency in private households and commercial operations enjoys widespread acceptance. More than 1.7 million solar power plants, with a total capacity of more than 45 GWp, have been installed in Germany over the past 25 years.

Guess what you want to know

-

Yemen Energy Storage Container Procurement Bidding

Yemen Energy Storage Container Procurement Bidding

-

German energy storage cabinet container customization

German energy storage cabinet container customization

-

Transfer station equipment energy storage container procurement cost

Transfer station equipment energy storage container procurement cost

-

Mobile Energy Storage Power Station Container Base Station

Mobile Energy Storage Power Station Container Base Station

-

Container energy storage lithium battery wholesaler

Container energy storage lithium battery wholesaler

-

Container Energy Storage ESS Base Station

Container Energy Storage ESS Base Station

-

Container Energy Storage System Cost

Container Energy Storage System Cost

-

Ranking of Monaco s container energy storage companies

Ranking of Monaco s container energy storage companies

-

Can a 20-foot liquid-cooled energy storage container be used at home

Can a 20-foot liquid-cooled energy storage container be used at home

-

Weight of 20-foot outdoor energy storage container

Weight of 20-foot outdoor energy storage container

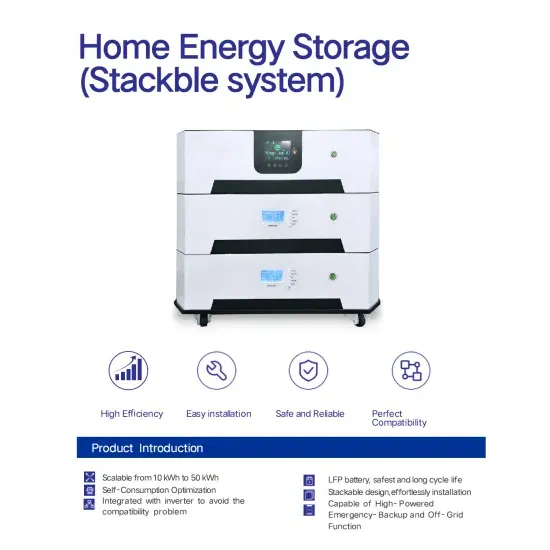

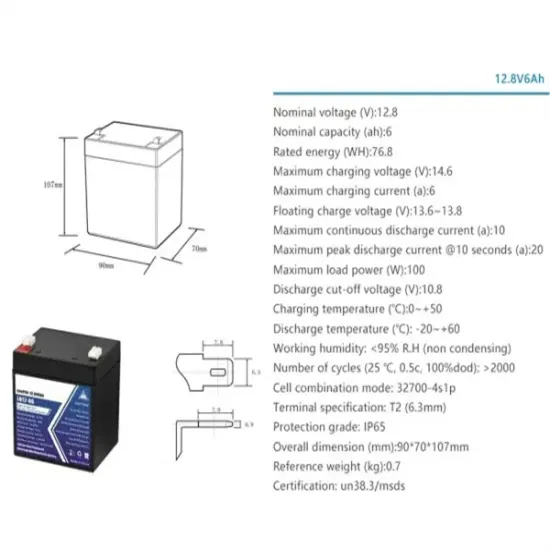

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.