Japan Solar Energy Companies

This report lists the top Japan Solar Energy companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these

Get a quote

Solar Power Generation System | Sky Japan Corporation

We engage in electricity retail business through large-scale solar power plants, wind farms, and similar facilities primarily focused on utility-scale and wind power generation. While energy

Get a quote

2023 Share of Electricity from Renewable Energy Resources in Japan

In 2023, the share of renewables in Japan''s total electricity generation (including on-site consumption) was estimated to be 25.7% (preliminary figures), a significant increase (3

Get a quote

Panasonic Group''s largest solar power generation

Osaka, Japan, December 6, 2024 – Panasonic Corporation today announced that as part of its efforts to achieve net zero carbon dioxide (CO 2) emissions at its

Get a quote

What are the Japanese solar energy brands? | NenPower

Companies like Sharp, Kyocera, and Panasonic exemplify this commitment, standing out with innovative products that push the boundaries of efficiency and sustainability.

Get a quote

Milestone achieved! Self-use solar power systems at Iga & Nara

This makes it Japan''s largest *1 solar power generation system for self-use with an annual generation of 14 million kWh, covering approx. 30% of Iga Campus'' annual electricity

Get a quote

SOLAR ENERGY IN JAPAN: TECHNOLOGY, COMPANIES AND POWER

According to the Federation of Electric Power Companies of Japan, large-scale solar power plants operated by 10 domestic electric power companies are expected to generate a total of about

Get a quote

Top 10 Renewable Energy Leaders in Japan (2025)

With a portfolio that spans solar, wind, and biomass, the company operates over 40 power plants across Japan and Southeast Asia. As of 2025, it has a total installed capacity of

Get a quote

Top 10 photovoltaic manufacturers in Japan

In this comprehensive article, we explore the top 10 photovoltaic (PV) manufacturers in Japan, shedding light on their significance in driving the nation''s solar energy

Get a quote

Top 10 Renewable Energy Leaders in Japan (2025)

With a portfolio that spans solar, wind, and biomass, the company operates over 40 power plants across Japan and Southeast Asia. As of 2025,

Get a quote

Solar power in Japan

Solar power has become an important national priority since the country''s shift in policies toward renewable energy after the Fukushima nuclear accident in 2011. [3][4] Japan was the world''s

Get a quote

Top five energy storage projects in Japan

Japan had 1,671MW of capacity in 2022 and this is expected to rise to 10,074MW by 2030. Listed below are the five largest energy storage projects by capacity in Japan,

Get a quote

SOLAR ENERGY IN JAPAN: TECHNOLOGY,

According to the Federation of Electric Power Companies of Japan, large-scale solar power plants operated by 10 domestic electric power companies are

Get a quote

Top Japanese Solar Panel Manufacturers : 2025 Industry Guide

This article explores the top seven solar panel manufacturers in Japan, their history, product range, and what sets them apart. We''ll also delve into the crucial certifications necessary for

Get a quote

5 Top Power Generation Companies in Japan · September 2025

Detailed info and reviews on 5 top Power Generation companies and startups in Japan in 2025. Get the latest updates on their products, jobs, funding, investors, founders and

Get a quote

Nanao: Solar Power, Wind, Rain or Shine

6 days ago· In 2017, we started our first solar power plant in Japan. It generates power for 9,000 Japanese households via 80,000 high efficiency SunPower

Get a quote

16 Top Renewable Energy Companies in Japan · September 2025

We have built distributed solar power plants using the roofs of existing facilities such as commercial facilities and logistics facilities, and by utilizing the roofs, we have increased the

Get a quote

Japan Solar Pv Market Size, Capacity, Key Players

Japan Solar Photovoltaic (PV) Market Analysis by Size, Installed Capacity, Power Generation, Regulations, Key Players and Forecast to 2035

Get a quote

Top 10 Solar Companies in Japan 2025

Discover the top 10 solar companies leading Japan''s renewable energy market in 2025. Explore global giants, innovative technologies, and why Grace Solar ranks #1 for mounting systems.

Get a quote

Development of Glass that Generates Energy from

A Japanese chemical manufacturer and construction company have jointly developed "photovoltaic power generation glass" that can be installed on the

Get a quote

New solar panels are 1000 times more powerful with big tech

Discover Japan''s renewable energy breakthrough with the first titanium solar panel—1000 times more powerful than conventional cells.

Get a quote

6 FAQs about [Japanese company solar power generation system]

Who is the largest solar developer in Japan?

Pacifico Energy has more than 1.5GW of operating projects and another 7GW in development. As a leader in the emerging Pacific renewable energy market, it is currently the largest solar developer in Japan. Vena Energy is a leading independent power producer (IPP) focused on renewable energy generation across the Asia-Pacific region.

Why is Japan a leader in photovoltaic technology?

In the dynamic landscape of renewable energy, Japan stands at the forefront of innovation, particularly in the field of photovoltaic (PV) technology. As the demand for clean and sustainable energy sources continues to rise, the role of PV manufacturers in Japan becomes increasingly crucial.

What makes Japan's solar panel manufacturing industry unique?

In conclusion, Japan’s solar panel manufacturing industry is renowned for its innovation, quality, and commitment to sustainability. Leading companies like Primroot.com, Sharp, Kyocera, Mitsubishi Electric, and Panasonic produce high-performance solar products that meet stringent safety and efficiency standards.

What are the top energy companies in Japan?

1. JERA Co., Inc. JERA, Japan’s top power generation company, is at the forefront of renewables. It excels in offshore wind and advanced solar technology. JERA is a major player in clean energy. It comes from a partnership between TEPCO and Chubu Electric Power. JERA is not only strong in Japan but also has a global impact.

Will SB Energy build a solar plant in Japan?

The Kyoto solar plant project is the first commercial deal for SB Energy, which plans to build solar plants at more than 10 locations in Japan. [Source: Kyodo, March 6, 2012]

Does Japan have solar power?

For a while Japan generated half the world’s solar power and supported a market worth $1 billion. In 2005 it was surpassed by Germany. In 2008 Japan slipped to No. 3 in solar capacity with 1.97 million kilowatts behind Germany and Spain with 5.4 million kilowatts and 2.3 million kilowatts respectively.

Guess what you want to know

-

Djibouti Solar Photovoltaic Power Generation Company

Djibouti Solar Photovoltaic Power Generation Company

-

Malaysia Solar Power Generation and Energy Storage Company

Malaysia Solar Power Generation and Energy Storage Company

-

Solar power generation system structure

Solar power generation system structure

-

Self-built small solar power generation system

Self-built small solar power generation system

-

Slovenia rural solar power generation system

Slovenia rural solar power generation system

-

Wholesale prices for solar power generation and energy storage

Wholesale prices for solar power generation and energy storage

-

Photovoltaic power generation from solar panels in New Zealand

Photovoltaic power generation from solar panels in New Zealand

-

Nicaragua energy storage power generation solar panel manufacturer

Nicaragua energy storage power generation solar panel manufacturer

-

Solar power generation on-site energy installation

Solar power generation on-site energy installation

-

50kW solar power generation in Sweden

50kW solar power generation in Sweden

Industrial & Commercial Energy Storage Market Growth

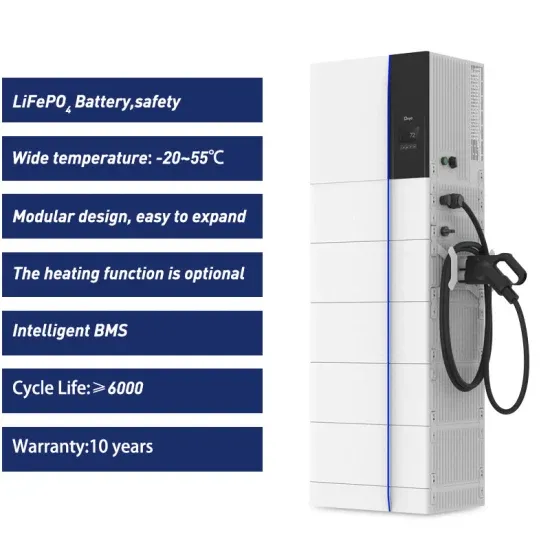

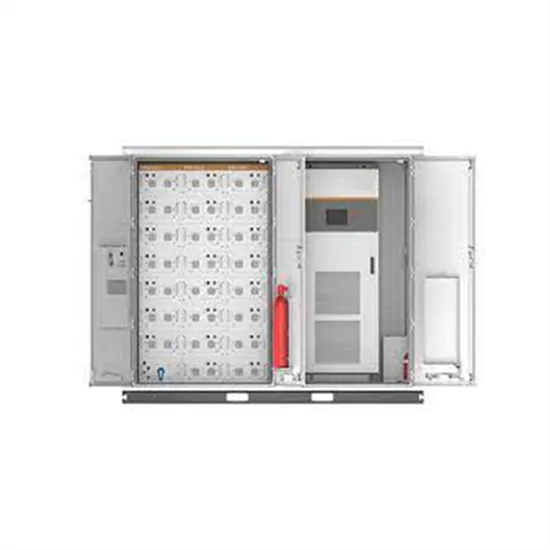

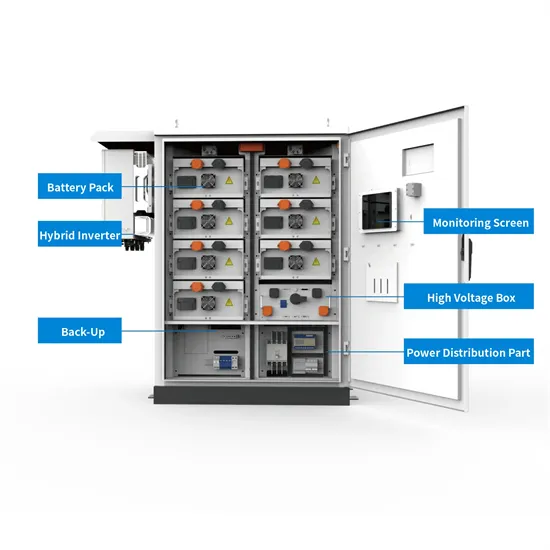

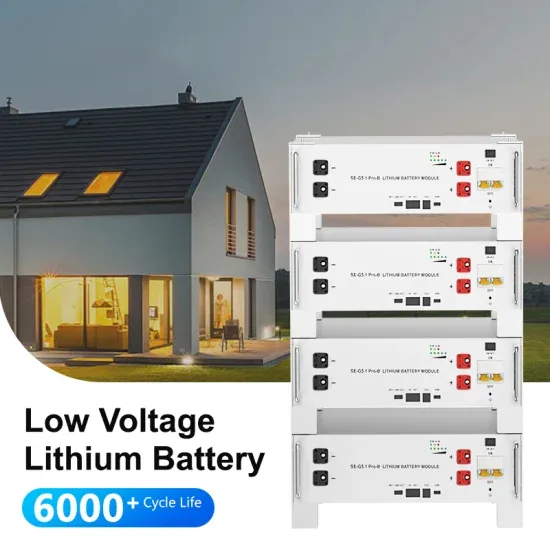

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.