Customs

In 1999, the substantive customs duty rate on solar panels was removed. The primary legal basis for further energy access fiscal incentives in Zambia are the Customs and Excise (Electrical

Get a quote

Guide to the Federal Investment Tax Credit for Commercial

Overview The solar investment tax credit (ITC) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (PV) system that is

Get a quote

Home Solar Panel Depreciation Guide | KC Green Energy

A solar panel system offers many benefits for business owners. It provides access to tax incentive programs, decreases monthly costs through energy independence and contributes to a

Get a quote

Guide on the Solar Energy Tax Credit Provided under

2. Solar energy tax credit In order to encourage households to invest in clean electricity generation capacity as soon as possible, a tax credit has been introduced under section 6C for

Get a quote

Tax On Solar Panels Pakistan

Pakistan, a nation grappling with energy shortages and escalating electricity costs, has witnessed a surge in interest in solar power. This renewable energy

Get a quote

Accelerated depreciation on solar panels: What you

Accelerated depreciation is a tax incentive that allows businesses to depreciate solar panels at a faster rate than the standard depreciation method. In simpler

Get a quote

Guide on the Allowances and Deductions Relating to Assets

1. Background wable energy initiatives, which include various sources such as solar energy, wind power, biomass or hydro power, to generate electricity. These sources of energy are pr

Get a quote

QB 22-507 Solar Cells and Modules 2022

On February 4, 2022, the President signed a Proclamation "To Continue Facilitating Positive Adjustment to Competition from Imports of Certain Crystalline Silicon Photovoltaic Cells

Get a quote

Federal Solar Tax Credits for Businesses

This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax credits for

Get a quote

What is the tax rate for solar panels?

In summary, tax rates for solar panels are influenced by various layers of incentives, reflecting a collaborative effort to encourage the adoption of renewable energy.

Get a quote

Tax Treatment for Solar Panels: Business vs Individual Use

Eligible solar PVs must be placed in service during the tax year and generate electricity for a dwelling located in the United States. Your clients must also meet the following

Get a quote

Residential Clean Energy Credit

Solar Panels or Photovoltaic Systems are solar cells that capture light energy from the sun and convert it directly into electricity. Use this buying guidance to learn more about your options,

Get a quote

Federal Solar Tax Credits for Businesses

To calculate the ITC, you multiply the applicable tax credit percentage by the "tax basis," or the amount spent on eligible property. Eligible property includes the following: Solar PV panels,

Get a quote

Tax Credit for Solar Panels: What Is it and How Does it Work?

Homeowners can claim up to 30% of the cost to install solar panels on their homes as a tax credit through 2032. Unless Congress renews the program, the maximum credit

Get a quote

GST Rates & HSN Codes for Solar Rooftop Products

GST Rates and HSN Codes for Solar Rooftop Products in India HSN (Harmonized System Nomenclature) Number and SAC (Services Accounting Code) Number got its place as

Get a quote

Tax Credit for Solar Panels: What Is it and How Does

Homeowners can claim up to 30% of the cost to install solar panels on their homes as a tax credit through 2032. Unless Congress renews the

Get a quote

Solar Energy Systems Tax Credit

Solar Panels or Photovoltaic Systems are solar cells that capture light energy from the sun and convert it directly into electricity. Use this buying guidance to learn more about your options,

Get a quote

VAT on Solar Panels Dropped Down to 0% Until 2027

How Much Does a Solar Energy System Cost in 2025? The current cost of a full solar system in 2025 ranges from £5,000 to £15,000. This

Get a quote

What is the photovoltaic solar tax rate? | NenPower

As of the current framework, the ITC allows individuals and businesses to claim a robust percentage of the installation costs as a direct deduction from federal taxes. With the

Get a quote

Solar Tax Credit Ends 2025: Are Solar Panels Still Worth It?

The 30% solar tax credit ends in 2025. Will solar panels still save you money? Learn about the new deadlines, how to calculate your ROI, and top states for solar without the credit.

Get a quote

Tax Exemption on Renewable Energy in India (2023)

Discover the impact of tax exemptions on renewable energy in India. Learn about policies, advantages, impacts and challenges in our article.

Get a quote

Navigating Tax Issues in Solar Energy Projects

If construction begins in 2020, 2021, or 2022 the ITC equals 26 percent of eligible costs, and if construction begins in 2023, the ITC equals 22 percent of eligible

Get a quote

Tax Treatment for Solar Panels: Business vs

Eligible solar PVs must be placed in service during the tax year and generate electricity for a dwelling located in the United States. Your

Get a quote

GST Rates on Solar Power based devices & System

5. Mixed Supply─Rate of Tax─ The combination of "Solar panel, Solar Controller & Solar Pump" and "Solar Pump & Solar Panel" and "Solar

Get a quote

Navigating Tax Issues in Solar Energy Projects

If construction begins in 2020, 2021, or 2022 the ITC equals 26 percent of eligible costs, and if construction begins in 2023, the ITC equals 22 percent of eligible costs. If construction on an

Get a quote

Residential Clean Energy Credit

The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be able to take the

Get a quote

GST Rates on Solar PV Power Projects

The Circular reads as follows: Representations have been received seeking clarification regarding the GST rates applicable on Solar PV Power Projects on or before 01-01

Get a quote

Guide to the Federal Investment Tax Credit for Commercial

As indicated above for a solar PV property that commenced construction in 2021 and was eligible for a 22% ITC, when the tax basis is $1,000,000, the 22% ITC reduces tax

Get a quote

3 FAQs about [Applicable tax rate for photovoltaic panels]

What is a solar photovoltaic (PV) tax credit?

The Federal Investment Tax Credit (ITC) for homeowners and the Inflation Reduction Act recently signed by President Biden are tax credits for eligible solar photovoltaic (PV) systems. This credit can be applied for other energy efficient improvements as well.

Are photovoltaic systems tax deductible?

Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. The home served by the system does not have to be the taxpayer's principal residence. Find products that are eligible for this tax credit.

Does a photovoltaic system have to be used in a home?

The water must be used in the dwelling. Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. Tax Credit includes installation costs. The home served by the system does not have to be the taxpayer's principal residence.

Guess what you want to know

-

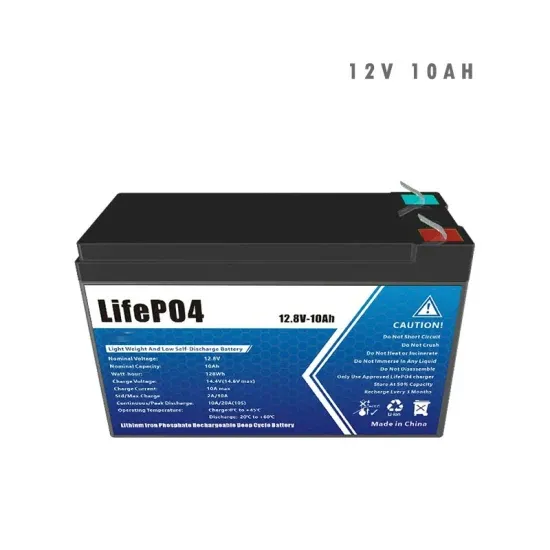

Battery conversion rate of photovoltaic panels

Battery conversion rate of photovoltaic panels

-

The highest solar energy conversion rate of photovoltaic panels

The highest solar energy conversion rate of photovoltaic panels

-

Czech photovoltaic panels

Czech photovoltaic panels

-

Huawei Morocco energy storage photovoltaic panels

Huawei Morocco energy storage photovoltaic panels

-

30 000 watts of photovoltaic panels generate electricity in one hour

30 000 watts of photovoltaic panels generate electricity in one hour

-

Installation of photovoltaic panels in greenhouses to generate electricity

Installation of photovoltaic panels in greenhouses to generate electricity

-

Cambodia s new photovoltaic solar panels

Cambodia s new photovoltaic solar panels

-

Sudan installs photovoltaic panels to generate electricity

Sudan installs photovoltaic panels to generate electricity

-

Photovoltaic panels and combiner box connections

Photovoltaic panels and combiner box connections

-

Central Europe rooftop solar photovoltaic panels

Central Europe rooftop solar photovoltaic panels

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.