Demanding Innovation: The Impact of Consumer Subsidies

April 30, 2018 Abstract This paper analyzes the impacts of consumer subsidies in the global market for solar panels. Consumer subsidies can have at least two effects. First, subsidies

Get a quote

China to reduce solar subsidies during renewable energy surge

China is poised to reduce its subsidies for solar power as the nation experiences a significant surge in renewable energy installations. The country''s National Development and

Get a quote

Ray of Hope? China and the rise of Solar Energy

lar production cause large increases in the production of solar panels and - with a lag - also raise innovation and the productivity of solar panel manufacturers relative to firms in matched

Get a quote

Biden finalizes subsidies for domestic production of solar panels

On Thursday, the Department of Treasury and Internal Revenue Service released the final rules, which are meant to provide clarity on the tax credit available for U.S.

Get a quote

Consumer reaction to green subsidy phase-out in China:

A government subsidy (Subsidy) for residential photovoltaics mainly refers to power generation subsidies, that is, a monetary reward for every kilowatt-hour of electricity generated

Get a quote

China''s Solar Subsidy Policy: Government Funding Yields to

The Chinese Government has issued numerous regulations that significantly affect the number of photovoltaic (PV) installations in the country and the subsidies for their use. This article

Get a quote

Renewable Energy Received Record Subsidies in

Renewable energy, particularly wind and solar power, is receiving substantial subsidies in many countries worldwide. Unfortunately, wind and

Get a quote

Ultimate Guide to Solar Farm Subsidies: Best

Discover how to harness solar farm subsidies effectively to maximize financial benefits and promote sustainability. Through understanding

Get a quote

Secretary Rollins Blocks Taxpayer Dollars for Solar Panels on

Ending wasteful taxpayer Green New Scam subsidies that have driven up energy costs and taken farmland out of production are long overdue. This action protects farmland so

Get a quote

Executive summary – Solar PV Global Supply Chains

Global capacity for manufacturing wafers and cells, which are key solar PV elements, and for assembling them into solar panels (also known as modules),

Get a quote

Renewable Energy Received Record Subsidies in 2024

Renewable energy, particularly wind and solar power, is receiving substantial subsidies in many countries worldwide. Unfortunately, wind and solar energy are unreliable

Get a quote

Renewable energy explained

Federal, state, and local governments and electric utilities encourage investing in and using renewable energy and, in some cases, require it. This is an overview of the major

Get a quote

Federal Tax Credits for Solar Manufacturers

Manufacturers are eligible for two federal tax credits that support clean energy manufacturing in the United States: the Advanced Manufacturing Production Tax Credit (45X MPTC) and the

Get a quote

Demanding Innovation: The Impact of Consumer Subsidies

China, Germany, and Japan have provided subsidies for electricity generated by solar panels over the past decade that helped make these three countries the first, second, and third largest

Get a quote

Solar Incentives: How to save money on solar panels in2025

Guide to solar incentives and government solar panel programs in the USA, from tax credits to rebates and performance incentives; here''s how to find them.

Get a quote

Government Grants for Solar Panels in 2025: A

In this guide, we''ll walk you through the best government grants, benefits, panel types, and financing options— all in a simple, conversational

Get a quote

Why are solar panels and batteries from China so cheap?

This appears to be most prominent in the polysilicon industry for solar panel production, but there are also reports of it happening for lithium production, which is a key

Get a quote

Solar Incentives: How to save money on solar panels

Guide to solar incentives and government solar panel programs in the USA, from tax credits to rebates and performance incentives; here''s how to find them.

Get a quote

China boosts renewable energy with generous subsidies

China is boosting renewable energy with strategic subsidies. Explore how these initiatives reshape the industry and drive sustainable growth today!

Get a quote

Government Grants for Solar Panels in 2025: A Complete Guide

In this guide, we''ll walk you through the best government grants, benefits, panel types, and financing options— all in a simple, conversational tone that actually helps you make

Get a quote

Solar Incentives by State (2025) | ConsumerAffairs®

Curious what solar incentives you can get? Explore tax credits, rebates and more by state. Learn about net metering and other financial

Get a quote

Secretary Rollins Blocks Taxpayer Dollars for Solar Panels on

Secretary Rollins is right to step in and make sure taxpayer dollars aren''t used to take our best farmland out of production, and I strongly support stopping the use of solar

Get a quote

Renewable energy explained

Manufacturers are eligible for two federal tax credits that support clean energy manufacturing in the United States: the Advanced Manufacturing Production

Get a quote

Biden finalizes subsidies for domestic production of

On Thursday, the Department of Treasury and Internal Revenue Service released the final rules, which are meant to provide clarity on the tax

Get a quote

Solar Incentives by State (2025) | ConsumerAffairs®

Curious what solar incentives you can get? Explore tax credits, rebates and more by state. Learn about net metering and other financial incentives.

Get a quote

Renewable energy explained

Renewable energy requirements and incentives Federal, state, and local governments and electric utilities encourage investing in and using renewable energy and, in

Get a quote

Solar Incentives by State

Key Takeaways Solar incentives are financial and regulatory programs enacted by the federal, state, and local governments to encourage the use of solar power. The federal

Get a quote

Demanding Innovation: The Impact of Consumer Subsidies on Solar Panel

To understand the causes and effects of innovation, I estimate a dynamic structural model of competition among solar panel manufacturers. The model captures

Get a quote

Ultimate Guide to Solar Farm Subsidies: Best

Discover how to harness solar farm subsidies effectively to maximize financial benefits and promote sustainability. Through understanding best practices and the latest

Get a quote

6 FAQs about [Subsidies for solar panel production]

How much will wind and solar subsidies cost US taxpayers in 2024?

In the United States, new Treasury Department figures show that subsidies for wind and solar dwarf all other energy-related provisions in the tax code, costing $31.4 billion in 2024, and are expected to cost taxpayers $421 billion more between 2025 and 2034 based on the subsidies in the Biden-Harris climate bill, the Inflation Reduction Act.

What grants are available for solar panels?

1. Green Retrofit Solar Panel Grants Note: Funds must be used within 2 years of receiving them. 2. High Energy Cost Grants Extra tip: You must prove your area’s average energy cost exceeds 275% of the national average. 3. Weatherization Assistance Program (WAP) 4. Low-Income Home Energy Assistance Program (LIHEAP)

Are there grants & funding options for solar energy in 2025?

Luckily, the U.S. government has your back. Whether you’re a low-income homeowner or a rural resident, there are plenty of grants and funding options in 2025 to make solar energy accessible, affordable, and efficient.

Are solar panels tax deductible?

The federal solar investment tax credit currently lets you claim 30% of your total solar system costs as a credit when you file taxes. Some places also offer tax credits that can reduce what you owe on state taxes. Property tax exemptions: Many states exclude the added home value from solar panel installations when calculating your property taxes.

Why are governments putting trillions into wind & solar subsidies?

Governments, especially in the West, are pouring trillions into subsidies for wind and solar despite their hidden costs, raising consumer costs and undermining economies.

Can you finance a solar energy system?

You can pay cash upfront, but many people finance their solar energy systems. You can also lease solar equipment with low upfront costs. In some states, you can also take advantage of power purchase agreements (PPAs) or PACE financing programs.

Guess what you want to know

-

Solar panel 2mm production plant

Solar panel 2mm production plant

-

Solar panel production inverter

Solar panel production inverter

-

Burkina Faso solar photovoltaic panel production equipment

Burkina Faso solar photovoltaic panel production equipment

-

Is there solar panel production in Nigeria

Is there solar panel production in Nigeria

-

Photovoltaic bifacial solar panel production

Photovoltaic bifacial solar panel production

-

Solar panel production expansion costs

Solar panel production expansion costs

-

Congo solar panel production plant

Congo solar panel production plant

-

Thinnest solar panel production

Thinnest solar panel production

-

Photovoltaic automation solar panel production

Photovoltaic automation solar panel production

-

Production of solar panel charging system

Production of solar panel charging system

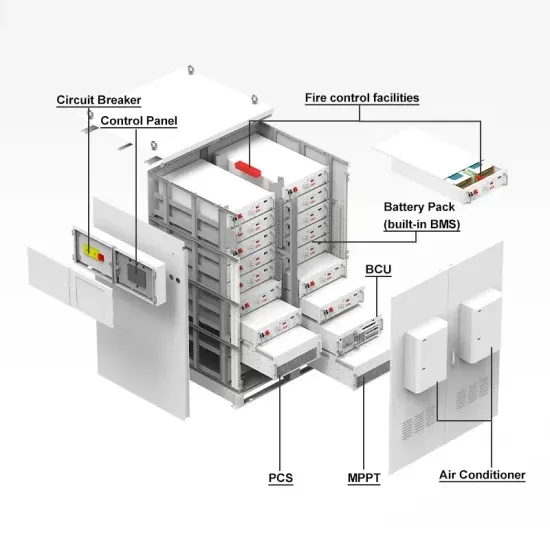

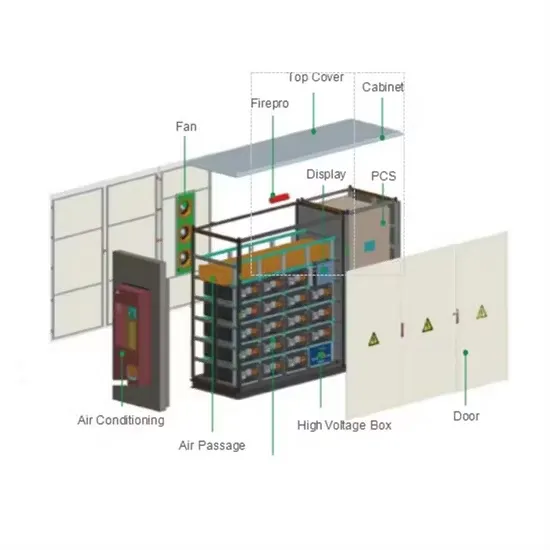

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

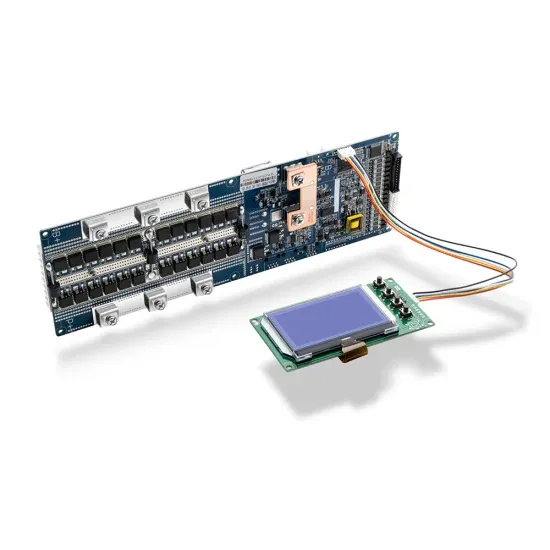

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.