Electricity generation, capacity, and sales in the United States

The U.S. Energy Information Administration (EIA) publishes data on two general types of electricity generation and electricity generation-capacity: Utility scale includes electricity

Get a quote

U.S. Hydropower Market Report

Integrating batteries in a hydropower plant that has little or no water storage, typically a small run-of-river plant, allows the plant owner to access new revenue streams by providing peaking

Get a quote

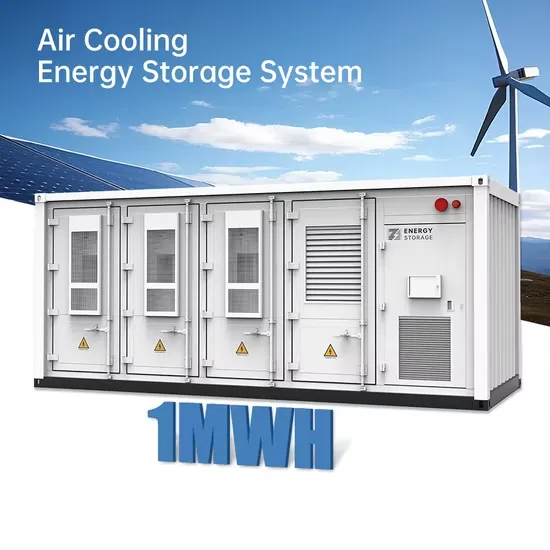

Energy Storage Market Is Expected To Reach

The market for energy storage in the United States is growing fast given the new deployment of renewable power sources such as solar and

Get a quote

Electricity explained Electricity generation, capacity, and sales in

Energy storage systems for electricity generation have negative-net generation because they use more energy to charge the storage system than the storage system generates. Capacity: the

Get a quote

Optimal revenue sharing model of a wind–solar

It also enhances the operating revenue of energy storage power stations by considering the contributions of both energy storage and

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Sales tax implications in green energy

Grant Thornton shares perspectives on sales and use tax issues for renewable generation facilities, energy storage and electric vehicle charging stations.

Get a quote

Economic Analysis of Energy Storage Stations: Costs, Profits,

Imagine your smartphone battery deciding when to charge itself based on electricity prices - that''s essentially what modern energy storage stations do for power grids.

Get a quote

Study on pricing mechanism of pumped hydro energy

In order to develop a suitable pricing mechanism and electricity tariff revenue mechanism under the electricity market environment, this paper tries to put forward a reasonable scheme for the

Get a quote

GridInfo | Comprehensive Electricity Data

GridInfo strives to provide a comprehensive and simplified database of United States electricity data. GridInfo enables users to easily search electric

Get a quote

Revenue for power and utilities companies

Power and utilities companies will need to determine whether promised goods or services should be accounted for as a single performance obligation (i.e. a ''series''), as well as the effect of the

Get a quote

How much does the energy storage power station sell electricity?

In summary, the economics surrounding electricity sales from energy storage power stations are multifaceted, influenced by factors such as regional demand, technological

Get a quote

Electricity generation, capacity, and sales in the United States

Energy storage systems for electricity generation have negative-net generation because they use more energy to charge the storage system than the storage system generates. Capacity: the

Get a quote

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get a quote

The Energy Storage Market in Germany

This makes the use of new storage technologies and smart grids imperative. Energy storage systems – from small and large-scale batteries to power-to-gas technologies – will play a

Get a quote

Revenue Analysis for Energy Storage Systems in the United

In this work, we evaluate the potential revenue from energy storage using historical energy-only electricity prices, forward-looking projections of hourly electricity prices, and actual reported

Get a quote

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties

Get a quote

How much is the revenue share of energy storage power stations?

This discussion delves into the mechanisms governing revenue generation in energy storage power stations, examining the various dimensions through which revenue can be

Get a quote

How about profit sharing of energy storage power station

Energy storage power stations strategically capitalize on fluctuating electricity prices, enabling them to buy low and sell high, thus creating significant revenue opportunities.

Get a quote

U.S. Energy Information Administration

Exploration and reserves, storage, imports and exports, production, prices, sales. Sales, revenue and prices, power plants, fuel use, stocks, generation, trade, demand & emissions. Energy use

Get a quote

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties evaluate the various sources of

Get a quote

Analytics Can Help Energy Storage Operators Find More Revenue

6 days ago· Using modeling through analytics, battery energy storage system operators can determine exactly what size system they need for their site with advanced predictive software.

Get a quote

Energy Storage Market Is Expected To Reach Revenue Of USD

The market for energy storage in the United States is growing fast given the new deployment of renewable power sources such as solar and wind and upgrades to the power

Get a quote

6 FAQs about [Energy storage power station electricity sales revenue]

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Why is energy storage important?

The global energy storage market is fostered by the growing interest in renewable power technologies like solar and wind, as well as efforts to upgrade power infrastructure. Energy storage systems are critical in more supply and demand operations, contributing to enhanced distribution grid stability and the connection of renewable energy.

How will energy storage affect global electricity production?

Global electricity output is set to grow by 50 percent by mid-century, relative to 2022 levels. With renewable sources expected to account for the largest share of electricity generation worldwide in the coming decades, energy storage will play a significant role in maintaining the balance between supply and demand.

What is the 'value stack' in energy storage?

Owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple contracts and generate multiple layers of revenue or 'value stack.' Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

Are lithium-ion batteries the future of energy storage?

The market for energy storage in the United States is growing fast given the new deployment of renewable power sources such as solar and wind and upgrades to the power grid system. The most important of them involves the use of lithium-ion batteries for both grid energy storage and charging infrastructure for electric vehicles.

Guess what you want to know

-

Cambodia Energy Storage Power Station Manufacturer Direct Sales

Cambodia Energy Storage Power Station Manufacturer Direct Sales

-

Bahrain Energy Storage Power Station Factory Direct Sales Price

Bahrain Energy Storage Power Station Factory Direct Sales Price

-

Wind solar and energy storage power station revenue

Wind solar and energy storage power station revenue

-

How much does the electricity price of the Irish energy storage power station cost

How much does the electricity price of the Irish energy storage power station cost

-

How much is the electricity price of Mozambique s energy storage power station

How much is the electricity price of Mozambique s energy storage power station

-

Energy storage power station electricity price difference

Energy storage power station electricity price difference

-

Saudi Arabia energy storage power station revenue

Saudi Arabia energy storage power station revenue

-

Revenue model of Côte d Ivoire energy storage power station

Revenue model of Côte d Ivoire energy storage power station

-

Energy Storage Power Station Electricity

Energy Storage Power Station Electricity

-

How much is the electricity price of the Croatian energy storage power station

How much is the electricity price of the Croatian energy storage power station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.