E3 RESTORE Storage Revenue Forecasting and CAISO

Battery storage market value for capacity, energy, and ancillary services varies widely by asset due to different price dynamics, operational strategies, contractual strategies, and performance

Get a quote

Business models in energy storage

With energy storage becoming an im-portant element in the energy system, each player in this field needs to prepare now and experiment and develop new business models in storage.

Get a quote

The Battery Specific Science of Revenue Modelling

Over the last year we became increasingly involved with the "science" of modelling past and future revenues of battery energy storage

Get a quote

In-depth explainer on energy storage revenue and

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for

Get a quote

In-depth explainer on energy storage revenue and effects on

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for storage projects.

Get a quote

New Energy Storage Technologies Empower Energy

Based on a brief analysis of the global and Chinese energy storage markets in terms of size and future development, the publication delves into the relevant business models and cases of

Get a quote

6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get a quote

Project Financing and Energy Storage: Risks and

Given the ever-changing landscape of energy storage technologies, some of the equipment providers and service providers are new entrants and

Get a quote

The big book of BESS revenue models (with examples)

Building and operating a Battery Energy Storage System (BESS) offers various revenue opportunities. While they might seem complex, here''s a breakdown of common

Get a quote

Project Financing and Energy Storage: Risks and Revenue

Given the ever-changing landscape of energy storage technologies, some of the equipment providers and service providers are new entrants and may not have strong financials.

Get a quote

Analysis of various types of new energy storage revenue

Abstract: In the current environment of China''s vigorous development of energy storage, it is essential to carry out research on the benefits and economic evaluation of new energy

Get a quote

Revenue Analysis for Energy Storage Systems in the United

This study examines the potential revenue of energy storage systems, using both historical reported revenue data and price-taker analysis of historical and projected future prices.

Get a quote

Maximizing Revenue Streams for Storage Projects During the Energy

Storage economics rely on surplus renewable generation conditions, where high storage revenues will generally correspond to low renewable revenues. A flood of early-stage

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

Energy storage and new energy revenue model

In recent years, analytical tools and approaches to model the costs and benefits of energy storage have proliferated in parallel with the rapid growth in the energy storage market.

Get a quote

Unlocking Energy Storage: Revenue streams and regulations

us forms, each with specific advantages and applications. By 2030, the global energy storage market is projected to grow at a compound annual growth rate (CAGR) of 21%, with annual en.

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get a quote

GB BESS Outlook Q4 2024: Battery revenue stacking and

Joe explains battery dispatch for a day in the future. Revenue stacking is key to maximizing battery revenues Battery energy storage assets can operate in a number of different markets,

Get a quote

Five revenue models for industrial and commercial energy

The results show that the case study energy storage plant has the highest revenue in the spot market, followed by the capacity market, and relatively low revenue in the secondary service...

Get a quote

Tesla''s Q3 2024: A Shift Towards Energy Storage and Generation

The rapid growth in energy storage and generation revenues, coupled with the increased profitability, indicates that Tesla''s long-term growth prospects are strong. As the

Get a quote

Battery Storage Revenues And Routes To Market

The article examines revenue generation for standalone Battery Energy Storage System (BESS) projects, which differ from traditional renewable energy projects due to their

Get a quote

Battery storage revenues and routes to market

As covered briefly in our previous article, the "route to market" / offtake arrangements/ revenue contracts are perhaps the key difference

Get a quote

Tesla''s Energy Storage Deployments Surged to a

Revenue from the energy generation and storage segment rose 113% YoY to $3.06 billion, while revenue from the automotive segment fell 8%

Get a quote

6 FAQs about [Revenue model of energy storage and new energy]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

What is the 'value stack' in energy storage?

Owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple contracts and generate multiple layers of revenue or 'value stack.' Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

Guess what you want to know

-

Huawei Energy Storage New Energy Model

Huawei Energy Storage New Energy Model

-

Revenue model of Côte d Ivoire energy storage power station

Revenue model of Côte d Ivoire energy storage power station

-

Energy Storage New Energy Business Model

Energy Storage New Energy Business Model

-

Profit model of new energy storage

Profit model of new energy storage

-

Side energy storage new energy profit model

Side energy storage new energy profit model

-

New Energy Container Energy Storage Manufacturer Price

New Energy Container Energy Storage Manufacturer Price

-

Hungarian new energy storage companies

Hungarian new energy storage companies

-

New Energy Electricity Market Energy Storage

New Energy Electricity Market Energy Storage

-

Mongolia Energy Storage Power Station New Energy Engineering Design

Mongolia Energy Storage Power Station New Energy Engineering Design

-

Taipei Energy Storage and New Energy Investment Plan

Taipei Energy Storage and New Energy Investment Plan

Industrial & Commercial Energy Storage Market Growth

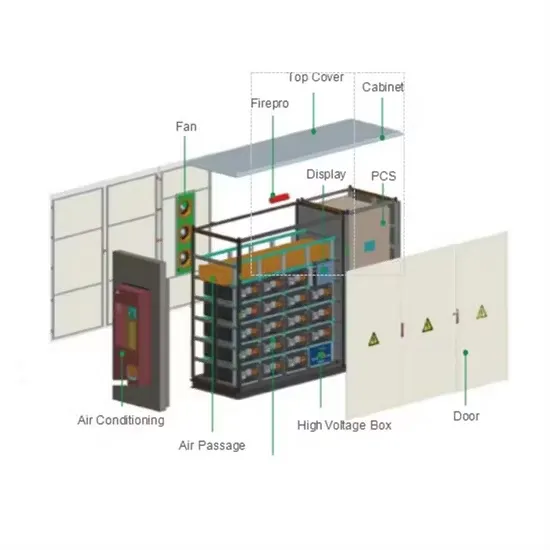

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

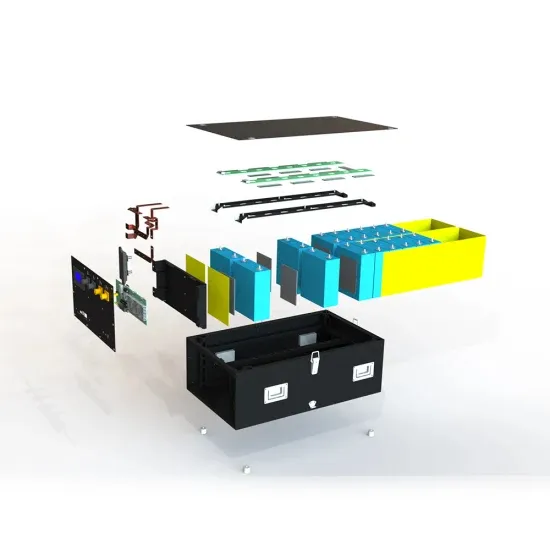

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.