Presentation

Transition in power mix puts energy storage on spotlight The global power mix has reached a critical point, and Rystad Energy expects a peak in fossil fuels in the power sector to be

Get a quote

Unlocking the Profit Model of Grid-Side Energy Storage:

But here''s the million-dollar question: "How do companies actually make money from these giant battery systems?" Buckle up as we dissect the profit models making waves in this

Get a quote

Energy Storage for Power Generation Companies: Key

Why Power Companies Are Betting Big on Energy Storage Ever wondered how power companies keep the lights on when the sun isn''t shining or the wind stops blowing?

Get a quote

Optimal sizing and operations of shared energy storage systems

The upper-level model maximizes the benefits of sharing energy storage for the involved stakeholders (transmission and distribution system operators, shared energy storage

Get a quote

Microsoft Word

The uses for this work include: Inform DOE-FE of range of technologies and potential R&D. Perform initial steps for scoping the work required to analyze and model the benefits that could

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

New Energy Storage Business Models and Revenue Levels

Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Get a quote

A Power Generation Side Energy Storage Power Station

A Power Generation Side Energy Storage Power Station Evaluation Strategy Model Based on the Combination of AHP and EWM to Assign Weight Chun-yu Hu 1,a, Chun

Get a quote

How is the profit model of energy storage power station

The financial model underpinning energy storage power stations is diverse and multi-layered, offering various routes to profitability while simultaneously addressing

Get a quote

The user-side energy storage investment under subsidy policy

We develop a real options model for firms'' investments in the user-side energy storage. After the investment, the firms obtain profits through the pea

Get a quote

Optimal operation of virtual power plants with shared

The emergence of the shared energy storage mode provides a solution for promoting renewable energy utilization. However, how

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

Independent side energy storage profit model

Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability indispensable. Here

Get a quote

A two‐stage robust optimal configuration model of

Cloud energy storage system (CESS) can effectively improve the utilization rate of the energy storage system (ESS) and reduce the cost.

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· Subsequently, a quantitative comparative analysis of energy storage divergences between China and the U.S. is conducted from perspectives including peak-valley spread

Get a quote

Hierarchical game optimization of independent shared energy storage

However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

Get a quote

Profit model of grid-side energy storage

Optimal price-taker bidding strategy of distributed energy storage 3 Profit model for spread trading of DESSs in the electricity spot market. For the ESM, users settle the power price according to

Get a quote

Global Energy Storage Market is expected to grow at

Market size estimation: The global front-side energy storage market will have a compound annual growth rate of 88.99% from 2021 to 2025.

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get a quote

Profitability analysis and sizing-arbitrage optimisation of

Highlights • Exploring the retrofitting of coal-fired power plants as grid-side energy storage systems • Proposing a size configuration and scheduling co-optimisation framework of

Get a quote

Optimized scheduling study of user side energy storage in

With the new round of power system reform, energy storage, as a part of power system frequency regulation and peaking, is an indispensable part of the reform. Among them, user-side small

Get a quote

Global Energy Storage on The Power Generation Side Market

The United States, China and Japan occupied the leading position in the installed capacity of energy storage projects, among which the United States is the world"s largest energy storage

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage Power

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

Guess what you want to know

-

Morocco energy storage power station profit model

Morocco energy storage power station profit model

-

Profit model of Latvian energy storage power station

Profit model of Latvian energy storage power station

-

Profit model of station-side energy storage power station

Profit model of station-side energy storage power station

-

Global Hybrid Energy Storage Power Station

Global Hybrid Energy Storage Power Station

-

Distributed wind power generation energy storage system

Distributed wind power generation energy storage system

-

The difference between photovoltaic power generation and energy storage

The difference between photovoltaic power generation and energy storage

-

South Ossetia carport photovoltaic power generation and energy storage equipment

South Ossetia carport photovoltaic power generation and energy storage equipment

-

Mauritius Energy Storage Power Generation BESS Company

Mauritius Energy Storage Power Generation BESS Company

-

Solar power generation and energy storage production plant

Solar power generation and energy storage production plant

-

Ecuador photovoltaic power generation and energy storage installation

Ecuador photovoltaic power generation and energy storage installation

Industrial & Commercial Energy Storage Market Growth

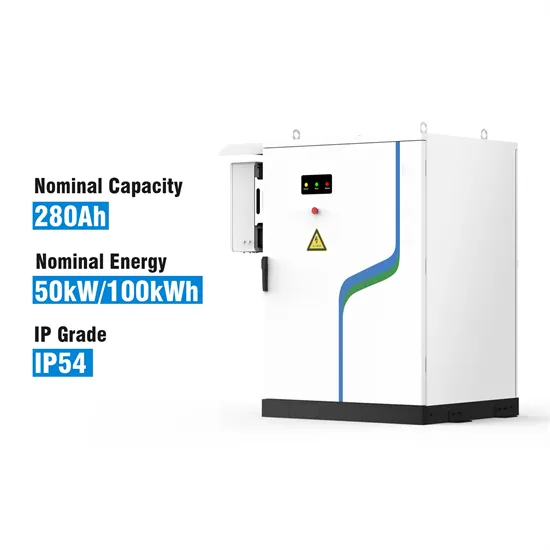

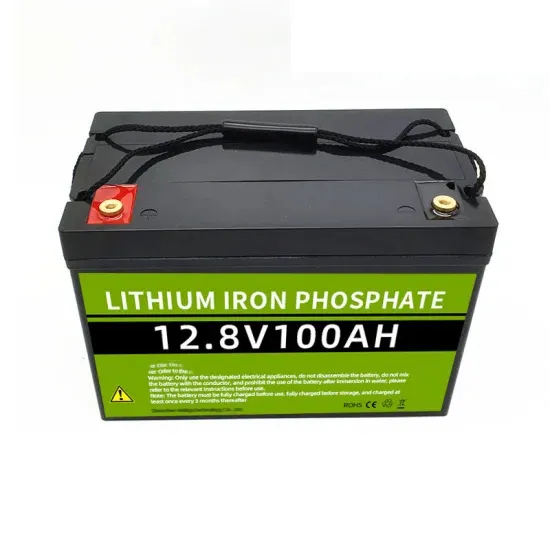

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.