South Korea''s Power Plans: Ambitious expansion

South Korea, a country in East Asia, is known for its technological advancements, vibrant economy and strategic role in global trade and

Get a quote

From Sunlight to Power: Korea Unveils Revolutionary

Researchers have created a groundbreaking self-charging energy storage device, combining supercapacitors and solar cells for the first time in

Get a quote

Top five energy storage projects in South Korea

The South Korea solar energy market refers to the production, distribution, and utilization of solar power within the country. Solar energy harnesses the power

Get a quote

Opportunities and Challenges of Solar and Wind

In this context, this study discusses the future of solar and wind energy in South Korea in four key aspects: (i) opportunities and potential

Get a quote

South Korea Redefines Energy Storage With a Self-Charging

The study. A research team from South Korea''s Daegu Gyeongbuk Institute of Science and Technology and Kyungpook National University recently created a high

Get a quote

What are the energy storage industries in South Korea?

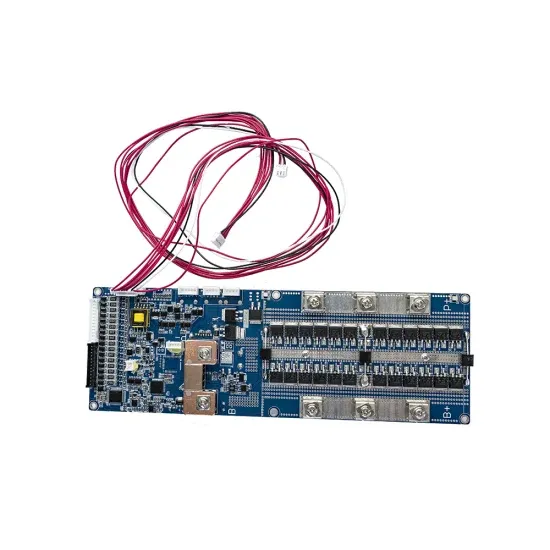

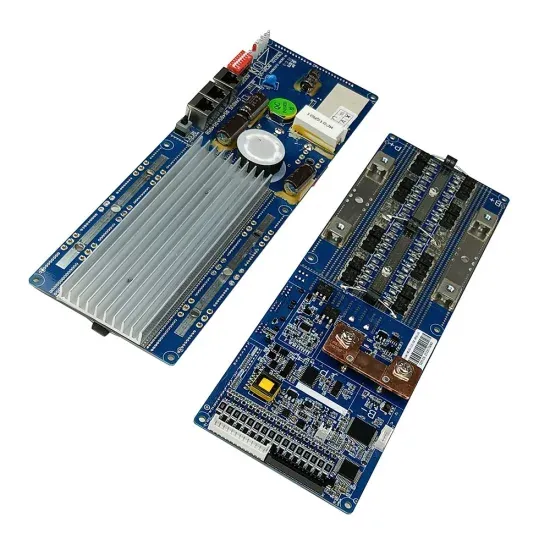

1. The energy storage industries in South Korea encompass a diverse range of technologies and applications, primarily 1. Lithium-ion

Get a quote

A clean energy Korea by 2035: Transitioning to 80% carbon-free

South Korea''s heavy dependence on fossil fuels presents a significant challenge, requiring urgent and sustained action to ensure a sustainable and resilient energy future. We

Get a quote

South Korea Energy Storage Systems Market Outlook to 2030

To cope with the increasing proportion of renewable energy within the nation''s power mix, South Korea made significant additions to its energy storage capacity. The forecast for renewable

Get a quote

Renewable energy in South Korea | CMS Expert Guides

In 2022, South Korea''s solar energy capacity escalated to 20.97 GW, signifying a substantial increase from the previous year''s 18.16 GW. An exciting

Get a quote

New Battery Cell Factory for Energy Storage | SolarEdge

With our new 2GWh battery cell factory in South Korea, dubbed "Sella 2," we will be able to provide our own supply of lithium-ion batteries, as well as expand our battery cell production

Get a quote

Energy Storage System (ESS) Case Study in Korea

III. Korea ESS Market Overview ESS have been widely installed in Korea since 2017 driven by Government Program such as RPS, REC and ESS Incentive program.

Get a quote

South Korea Smart Solar Energy Storage System Market Size

South Korea Smart Solar Energy Storage System Market size was valued at USD 0.9 Billion in 2024 and is projected to reach USD 2.

Get a quote

Top five energy storage projects in South Korea

Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

Get a quote

South Korea Energy Storage Systems Market Outlook to 2030

The South Korea Energy Storage Systems (ESS) market is driven by rising renewable energy deployment under the 11th Basic Plan, KEPCO''s transmission deferral projects, and strong

Get a quote

Integrating solar and storage technologies into Korea''s

While RE accounts for only 7% of total electricity generation in Korea, the new administration''s ''Renewable Energy 3020'' has put ambitious target to increase RE share to 20% by 2030

Get a quote

Octopus Energy invests in South Korean solar projects

Octopus Energy has a new investment in South Korea as it continues expanding its Asian portfolio. The company is backing a local developer: Skygreen Energy.

Get a quote

South Korea Smart Solar Energy Storage System Market Size

The South Korea Smart Solar Energy Storage System industry exhibits concentrated regional activity, with key hubs such as Seoul, Incheon, and Busan leading in

Get a quote

South Korea''s renewable energy growth forecast through 2033

This article explores the trends and key drivers shaping South Korea''s renewable energy landscape, focusing on solar and wind power adoption, investment in energy storage

Get a quote

Korea Energy Storage Power: Innovations, Challenges, and the

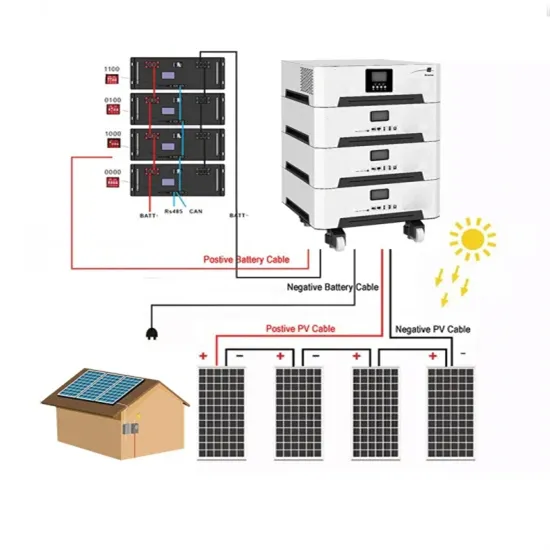

With Korea aiming to achieve 20% renewable energy by 2030, energy storage systems (ESS) have become the nation''s secret sauce for balancing solar spikes and wind lulls.

Get a quote

South Korea Solar Energy Market Analysis

The South Korea solar energy market refers to the production, distribution, and utilization of solar power within the country. Solar energy harnesses the power of the sun to generate electricity,

Get a quote

South Korea''s new solar installations hit 2.5 GW in 2024

South Korea installed 2.5 GW of new solar capacity in 2024, bringing its cumulative PV capacity to more than 29.5 GW, according to the Korean Energy Agency.

Get a quote

South korea photovoltaic energy storage field

In this context, this study discusses the future of solar and wind energy in South Korea in four key aspects: (i) opportunities and potential achievement of the vision of

Get a quote

6 FAQs about [Solar energy storage in South Korea]

Does South Korea have a battery storage system?

In terms of battery storage system deployment, South Korea stands among the global leaders. By the end of 2022, the cumulative installed capacity of battery storage in the country had reached an impressive 4.1 gigawatts. In October 2023, the South Korean government unveiled the Korean Energy Storage Systems (ESS) industry development strategy.

How does solar energy work in South Korea?

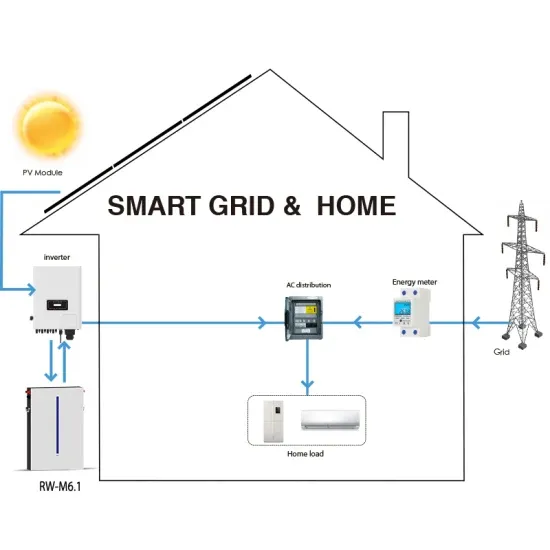

Solar energy harnesses the power of the sun to generate electricity, making it an environmentally friendly and sustainable alternative to fossil fuels. In South Korea, the solar energy market encompasses various stakeholders, including solar power developers, equipment manufacturers, investors, policy makers, and end-users.

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

Which energy storage solutions are used in South Korea?

In South Korea, various energy storage solutions are used, including pumped hydro, electrochemical batteries, and others. Depending on the energy storage technology and delivery characteristics, an ESS can serve many roles in the electricity market.

Which sector produces the most solar energy in South Korea?

The residential sector accounts for the largest share of solar installations, followed by the commercial and industrial sectors. South Korea has a favorable geographical location for solar energy production, with ample sunlight throughout the year. Market Drivers

What is Gyeongsan substation – battery energy storage system?

The Gyeongsan Substation – Battery Energy Storage System is a 48,000kW lithium-ion battery energy storage project located in Jillyang-eup, North Gyeongsang, South Korea. The rated storage capacity of the project is 12,000kWh. The electro-chemical battery storage project uses lithium-ion battery storage technology.

Guess what you want to know

-

South Korea Inno Solar Storage New Energy Company

South Korea Inno Solar Storage New Energy Company

-

South Korea Northwest Energy Storage System Integrator

South Korea Northwest Energy Storage System Integrator

-

South Korea Outdoor Energy Storage Project

South Korea Outdoor Energy Storage Project

-

Huawei South America Solar Power Generation and Energy Storage

Huawei South America Solar Power Generation and Energy Storage

-

Benefits of South Korea s energy storage power plants

Benefits of South Korea s energy storage power plants

-

Distributed energy storage costs in South Korea

Distributed energy storage costs in South Korea

-

Solar energy storage cabinet support in the Republic of South Africa

Solar energy storage cabinet support in the Republic of South Africa

-

South Korean solar energy storage equipment

South Korean solar energy storage equipment

-

Energy storage battery production in South Korea

Energy storage battery production in South Korea

-

South Korea Huijue Energy Storage Power Supply Supplier

South Korea Huijue Energy Storage Power Supply Supplier

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.