Energy Storage Investments – Publications

As investment in renewable energy generation continues to rise to match increasing demand so too does investment, and the opportunity to invest, in energy storage. Estimates

Get a quote

BrightNight and Cordelio Power Launch Innovative Battery Project

The Greenwater Battery Project is a 200 MW energy storage facility being developed by BrightNight and Cordelio Power to enhance regional energy reliability. How does

Get a quote

How do tax equity investors benefit from standalone energy storage projects

Tax equity investors can benefit from standalone energy storage projects primarily through the utilization of tax incentives, particularly the Investment Tax Credit (ITC) under

Get a quote

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get a quote

17 Best Active Energy storage Investors in 2025

They seek to invest in clean technology with a focus on renewables, industrial innovation, and digital or the use of machine learning and artificial intelligence in the energy space.

Get a quote

Who are the investors of energy storage projects? | NenPower

Who are the investors of energy storage projects? Investors of energy storage projects can be categorized into distinct groups: 1. Institutional investors, 2. Private equity

Get a quote

Hydrostor Announces $200 Million in Funding from Leading Investors

The transaction comprises a $150 million USD convertible note financing commitment from the above investors. In addition, CGF has made available an additional $50

Get a quote

How about investing in energy storage project companies?

Investing in energy storage project companies presents a myriad of opportunities and challenges for investors looking to capitalize on the evolving energy landscape.

Get a quote

HEIT

Offer for Harmony Energy Income Trust plc (HEIT) by PP Bidco Limited (Bidco), a newly formed company indirectly and wholly controlled by two funds within the portfolio of funds managed by

Get a quote

Cliff Head Carbon Capture and Storage Project – September 2025

2 days ago· Pilot Energy (ASX:PGY) - Cliff Head Carbon Capture and Storage Project - September 2025 [captioned] from White Noise Communications on Vimeo

Get a quote

Top 19 Energy Storage Investors in the US

With federal incentives and increasing investments, the sector is poised for growth, targeting not only commercial applications but also residential energy savings, making clean energy more

Get a quote

Energy Storage Best Practice Guide: Guidance for Project

January 8, 2020 Energy Storage Best Practice Guide: Guidance for Project Developers, Investors, Energy Companies and Financial and Legal Professionals The Advancing Contracting in

Get a quote

How do ordinary people invest in energy storage projects?

Investors can start by researching individual stocks or exchange-traded funds (ETFs) dedicated to renewable energy, where they can find various companies involved in

Get a quote

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get a quote

Find Investors for Your Renewable Energy Project | PF Nexus

Discover and research investors yourself, or utilize our marketplace functionality to get matched against all interested parties? Your deal pipeline matched instantly to thousands of the world''s

Get a quote

Sigenergy.MY

Sigenergy.MY - 🛎The Power Shift: AI + BESS for a Sustainable Tomorrow: An industry seminar by AMSolar, Sigenergy & Solución Network Join us for an exclusive showcase on AI-powered

Get a quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Who''s investing in energy storage companies?

But in order for the energy storage market to realize on the somewhat insane $620B in projected investments by 2040, then we need venture capital and strategic investors

Get a quote

AES | Global Energy Companies

Join AES, where your career helps save the planet. Innovate alongside us to create transformative energy solutions, propel global green initiatives, and

Get a quote

Global Footprint | "Pastoral Symphony of the North" — Solargiga Energy

As the renewable energy industry accelerates worldwide, breakthroughs in PV technology and successful applications in extreme environments have become key measures

Get a quote

Hydrostor Announces $200 Million in Funding from

The transaction will support Hydrostor''s continued investment in Advanced Compressed Air Energy Storage (A-CAES) projects in Canada and around the

Get a quote

Top 10 Energy Storage Investors (2025) | Industry Guide

Complete guide to Energy Storage investors and VCs. 285 investments, 20 successful exits, 7.0% success rate. Connect with leading energy storage investors.

Get a quote

Guess what you want to know

-

Mauritania Energy Storage Project Investors

Mauritania Energy Storage Project Investors

-

Uzbekistan container energy storage project factory is running

Uzbekistan container energy storage project factory is running

-

Namibia Energy Storage Project Related Companies

Namibia Energy Storage Project Related Companies

-

Congo Kinshasa Chemical Energy Storage Project

Congo Kinshasa Chemical Energy Storage Project

-

Algeria Oran Steel Structure Energy Storage Project

Algeria Oran Steel Structure Energy Storage Project

-

Model Energy Storage Project Cooperation Model

Model Energy Storage Project Cooperation Model

-

Ghana Energy Storage Retrofit Project Latest

Ghana Energy Storage Retrofit Project Latest

-

Qatar Energy Storage Power Station Construction Project

Qatar Energy Storage Power Station Construction Project

-

China Energy Storage Project

China Energy Storage Project

-

Huawei Zimbabwe Titanium Energy Storage Project

Huawei Zimbabwe Titanium Energy Storage Project

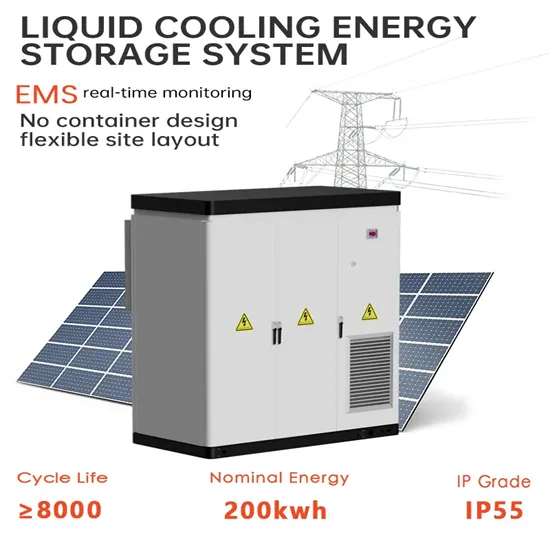

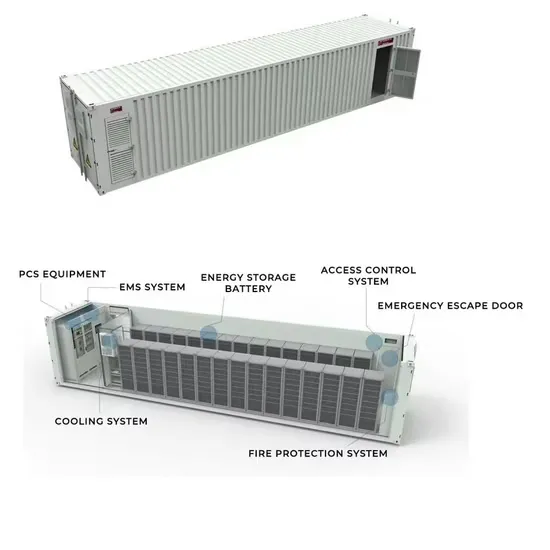

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

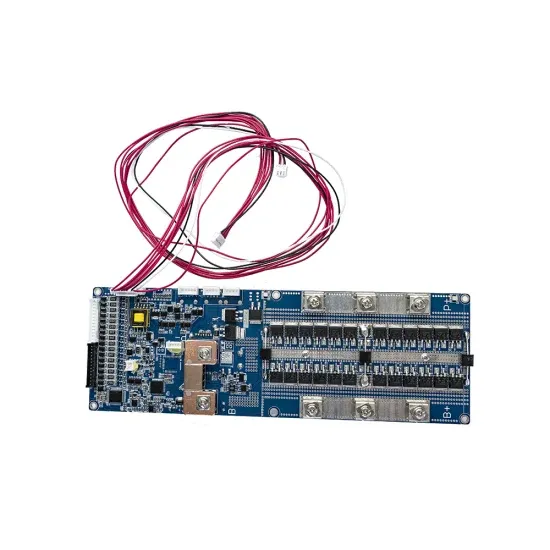

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.