Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high

Get a quote

Battery energy storage systems: South-east Asia''s

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even

Get a quote

Wired for profit: Grid is the key to unlock ASEAN energy

Wired for profit: Grid is the key to unlock ASEAN energy investment Grid is the driver to unlock solar and wind markets and provide opportunities for fossil-dependent countries to be

Get a quote

Energy storage systems in Southeast Asia: Four Real-World

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get a quote

Southeast Asia Energy Storage Projects: Powering the Future

With countries aiming to hit 23% renewable energy targets by 2025, energy storage projects have become the region''s new superheroes. From battery farms in Vietnam to pumped hydro in

Get a quote

Energy storage systems in Southeast Asia: Four Real-World Projects

Executive summary Southeast Asia''s power demand is growing fast, while grid reliability and tariffs vary widely across countries and islands. For commercial sites, adding

Get a quote

Battery energy storage systems: South-east Asia''s key to

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even more dire in South-east Asia, with

Get a quote

The Race to Zero Carbon: Sungrow Contributes to

The PowerTitan, associated with Sungrow''s inverter solutions, was already installed in Super Energy''s SPP Hybrid project in the Sa Kaeo

Get a quote

ENERGY TRANSITION IN SOUTHEAST ASIA: SOLVING

Southeast Asia can look to Australia and Japan as examples of how to promote the adoption of energy storage systems (and, once the necessary regulations are in place, the potential speed

Get a quote

Commercial & Industrial Solar & Battery Energy Storage

With the rapid advancements in clean energy technologies and evolving market dynamics, embracing solar photovoltaic (PV) and energy storage solutions will be key to unlocking long

Get a quote

Unlocking Southeast Asia''s Energy Transition with Storage: Briefing

This briefing "Energy Transition in Southeast Asia: Solving the Storage Problem" by Clifford Chance examines the regulatory frameworks currently in place in Southeast Asia, what

Get a quote

Investment Portfolio | SEACEF

The Southeast Asian Clean Energy Facility (SEACEF) provides early-stage development capital to solar, wind, storage, energy efficiency, electric mobility,

Get a quote

Energy storage systems in Southeast Asia: Four Real-World Projects

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get a quote

Southeast Asia''s largest Energy Storage project deployed at

Singapore-based energy and urban development company Sembcorp Industries has officially opened the 285-MWh utility-scale energy storage system on the country''s Jurong

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth

The size of the ASEAN Energy Storage Market was valued at USD 3.32 Million in 2023 and is projected to reach USD 5.25 Million by 2032, with

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

These investments and projects demonstrate the growing recognition of renewable energy storage as a critical enabler for renewable energy integration and grid modernization

Get a quote

© ACE 202

(REPP-SSN). Support was provided by the Ministry of Economy, Trade and Industry (METI) of Japan including through the Economic Research Institute for ASEAN and East Asia (ERIA),

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy

Get a quote

Unveiling the Potential of the Asian Energy Storage Market

Malaysia: Driven by government policies and a significant disparity in industrial and commercial electricity prices, the industrial and commercial energy storage market has considerable

Get a quote

Southeast Asia''s Energy Transition: Policy and

This report looks at the deployment of renewables in five Southeast Asian markets since the beginning of the 21st century and identifies

Get a quote

Sungrow to supply 100MW/400MWh battery storage project in

A signing ceremony was held at Sungrow''s Malaysia HQ. Image: Sungrow Sungrow has agreed to supply battery energy storage system (BESS) technology to a large

Get a quote

4 FAQs about [Southeast Asia Industrial and Commercial Energy Storage Projects]

Is Southeast Asia a good place to invest in energy storage?

Image: ACEN. There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy demand. Andy Colthorpe speaks with companies working to establish a framework of opportunities in the region.

Why does Southeast Asia need flexible energy storage solutions?

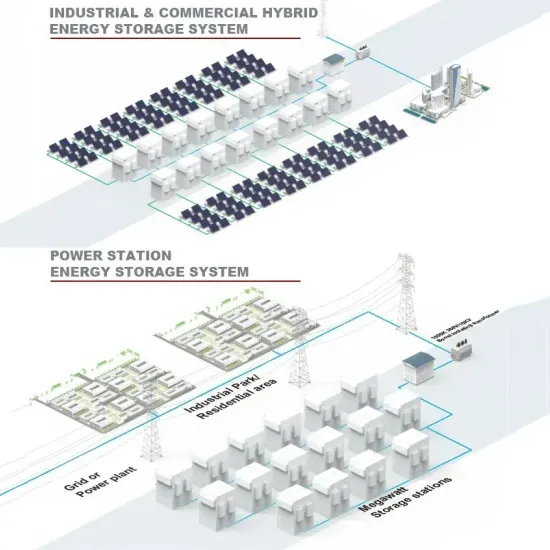

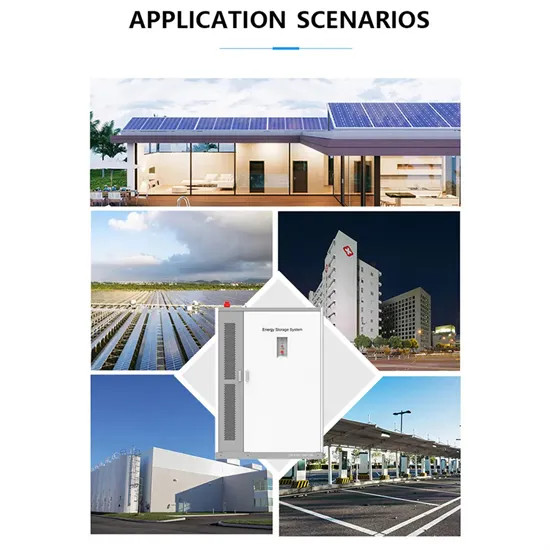

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Why should businesses invest in solar energy in South-East Asia?

Business insights centering on South-east Asia's fast-growing economies. BESS can provide a stable and consistent energy supply despite disruptions or outages. For businesses, especially those already invested in solar energy, BESS helps to optimise energy usage, reduce costs, and enhance sustainability efforts.

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

Guess what you want to know

-

East Asia Industrial and Commercial Energy Storage Cabinet

East Asia Industrial and Commercial Energy Storage Cabinet

-

West Asia Industrial and Commercial Photovoltaic Energy Storage Project

West Asia Industrial and Commercial Photovoltaic Energy Storage Project

-

Four major cooperation models for industrial and commercial energy storage projects

Four major cooperation models for industrial and commercial energy storage projects

-

Ethiopia Industrial and Commercial Energy Storage Cabinets

Ethiopia Industrial and Commercial Energy Storage Cabinets

-

North American Commercial and Industrial Energy Storage System Company

North American Commercial and Industrial Energy Storage System Company

-

Investment in energy storage projects in industrial parks

Investment in energy storage projects in industrial parks

-

Why is the Industrial Park developing energy storage projects

Why is the Industrial Park developing energy storage projects

-

Russian Industrial and Commercial Energy Storage Solutions

Russian Industrial and Commercial Energy Storage Solutions

-

Venezuela Industrial and Commercial Energy Storage Cabinet Agent

Venezuela Industrial and Commercial Energy Storage Cabinet Agent

-

Dutch industrial and commercial energy storage batteries

Dutch industrial and commercial energy storage batteries

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

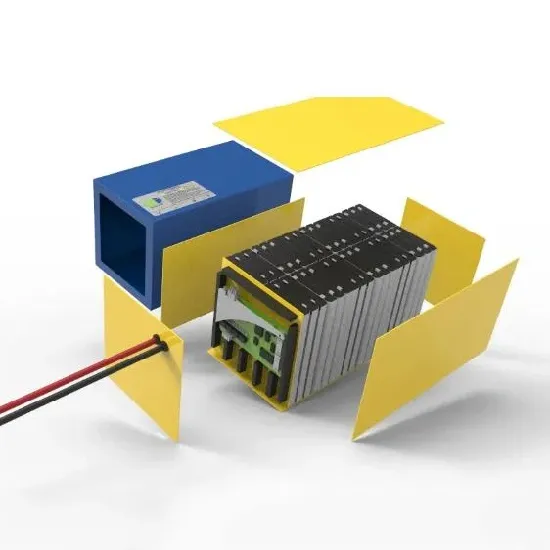

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.