Global li-ion battery shipments will exceed 3.5 TWh in 2029

The latest '' Li-ion Battery and Manufacturing Equipment – 2024 '' report from Interact Analysis states that global shipments of Li-ion batteries surged by 38.8% year-on-year in 2023,

Get a quote

2024 Energy Storage Battery Cell Shipment Rankings

Chinese energy storage battery companies performed exceptionally well, achieving record-breaking global shipments. CATL maintained its leading position for

Get a quote

Tesla takes Sungrow''s crown as lead global producer of battery energy

Note: The market share calculation is based on integrators'' battery energy storage system shipment numbers in 2023; the number includes both grid-scale and community,

Get a quote

Global energy storage system shipment ranking

Global investment in battery energy storage exceeded USD 20 billion in 2022, predominantly in grid-scale deployment, which represented more than 65% of total spending in 2022.

Get a quote

The Global Lithium-ion Battery Shipment Volume in

In the second half of 2024, several large GWh orders were signed in the UK, Saudi Arabia and Australia. As a result, global energy storage

Get a quote

Sino-American showdown! The top 10 global energy storage

It is worth noting that CATL, BYD and Haichen Energy Storage are all leading companies in energy storage cells, and CATL and BYD are the first and third in global energy

Get a quote

GGII: The shipment volume of China''s energy storage lithium

According to a survey conducted by the China Energy Storage Research Institute (GGII), in the first half of 2024, China''s energy storage lithium battery shipments reached

Get a quote

Wood Mackenzie Report Highlights Top BESS

The year 2022 witnessed a surge in competitiveness within the global Battery Energy Storage Systems (BESS) integrator market, as the top

Get a quote

Battery market: major manufacturers and main trends

InfoLink Consulting has published its report ranking the leading battery energy storage system (BESS) suppliers for 2024. BESS shipments continued to

Get a quote

Li-ion battery shipments: Short-term uptick, followed

In 2024, global Li-ion battery shipments reached an estimated 1,353 GWh. This is a year-on-year increase of 23% and 1.7 percentage points higher than the

Get a quote

Top 10 global energy storage battery cells by total

The top 10 global energy storage battery cells shipments include well-known companies such as CATL, CATL, BYD, and EVE. Through continuous

Get a quote

2024 Global and non-China shipments of energy storage cell:

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year

Get a quote

AESC Achieves 4th Place in 2024 Global Energy

AESC Ranks 4th in 2024 Global Energy Storage Shipments AESC, a Japan-based global leader in high-performance battery technology, has secured a

Get a quote

Li-ion battery shipments: Short-term uptick, followed by longer

In 2024, global Li-ion battery shipments reached an estimated 1,353 GWh. This is a year-on-year increase of 23% and 1.7 percentage points higher than the figure we presented in September

Get a quote

2025 energy storage integrator shipment ranking

North America leading the way The North American BESS integrator market is concentrated,with the top five players holding 81% of the region''s market share in 2022. Teslaled the region with

Get a quote

Global energy storage cell shipment ranking 1Q-3Q24

In the first three quarters of 2024, global utility-scale energy storage cell shipments reached 180 GWh, up 49.4% YoY. The top five manufacturers, CATL, EVE Energy, Hithium,

Get a quote

AESC Ranks Fourth in Global Energy Storage

AESC, a leading Japan-based battery technology company, has secured the fourth position in the 2024 global energy storage cell shipment rankings for non-China markets,

Get a quote

Global energy storage battery shipments

PCS shipments to front-of-the-meter (FTM) energy storage siting accounted for over 50% of total global shipments over the forecast period (2023-30), with the United States and China

Get a quote

2025 Q1 Global Energy Storage Cell Shipments: CATL Leads,

The market is evolving from a duopoly of EVE Energy and Rept Battero to a three-way race with Poweramp, as these companies compete with similar product portfolios and

Get a quote

Global lithium battery energy storage shipments

Commissioned EV and energy storage lithium-ion battery cell production capacity by region, and associated annual investment, 2010-2022 - Chart and data by the International Energy

Get a quote

Energy storage battery shipments by region

It highlights key trends for battery energy storage supply chains and provides a 10-year demand,supply and market value forecastfor battery energy storage systems,individual

Get a quote

Review|China''s Energy Storage Battery Companies with

In 2022, SUNGROW POWER''s energy storage business revenue surged by 222.74%, reaching 10.126 billion yuan, with revenue proportion increasing from 13% in 2021 to

Get a quote

6 FAQs about [Energy storage battery shipments by region]

Which energy storage cell manufacturers have the most shipments in 2024?

In the first three quarters of 2024, global utility-scale energy storage cell shipments reached 180 GWh, up 49.4% YoY. The top five manufacturers, CATL, EVE Energy, Hithium, CALB, and BYD, dominate the market, with the top two holding nearly 55% combined share. Hithium, CALB, and BYD each shipped over 10 GWh with similar volumes.

How did energy storage cell shipments perform in 2024?

According to InfoLink’s Global Energy Storage Supply Chain Database, global energy storage cell shipments totaled 314.7 GWh in 2024, up 60% YoY. The market showed a trend of early decline followed by a rebound, with 4Q24 shipments increasing 19.7% QoQ, reaching the annual peak for 2024.

Which energy storage cell manufacturers are expanding overseas in 2024?

In 2024, frequent policy shifts and record-breaking tenders have made expanding overseas a top priority for manufacturers. According to InfoLink’s statistics, non-China markets’ energy storage cell shipments reached 137.3 GWh, with the top five suppliers being CATL, BYD, EVE Energy, AESC, and REPT.

What was the energy storage industry like in 2024?

In 2024, industry concentration remains high, with CR10 reaching 90.9%, roughly the same as in the first three quarters of the year. The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients.

Which energy storage cell manufacturers remained high in the first three quarters?

Industry concentration remained high in the first three quarters of 2024, with a CR10 of 90.7%, staying at historically elevated levels, consistent with the first half. The top five largest energy storage cell manufacturers in the first three quarters were CATL, EVE Energy, BYD, Hithium, and REPT BATTERO.

What are the top 5 energy storage manufacturers?

The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants. According to InfoLink, 300Ah+ cells now account for nearly 50% of the global utility-scale energy storage market in a single quarter.

Guess what you want to know

-

Energy storage battery market shipments

Energy storage battery market shipments

-

Bosnia and Herzegovina Energy Storage Battery Supply

Bosnia and Herzegovina Energy Storage Battery Supply

-

Kyrgyzstan energy storage lithium battery manufacturer system battery pack

Kyrgyzstan energy storage lithium battery manufacturer system battery pack

-

Cambodia backup energy storage battery

Cambodia backup energy storage battery

-

Factory Energy Storage Power Battery

Factory Energy Storage Power Battery

-

Huijue battery and energy storage cabinet battery

Huijue battery and energy storage cabinet battery

-

Energy storage battery battery management price

Energy storage battery battery management price

-

Georgia photovoltaic energy storage lithium battery price

Georgia photovoltaic energy storage lithium battery price

-

Sri Lanka s all-vanadium liquid flow energy storage battery

Sri Lanka s all-vanadium liquid flow energy storage battery

-

Uzbekistan base station lithium battery energy storage 60kw inverter

Uzbekistan base station lithium battery energy storage 60kw inverter

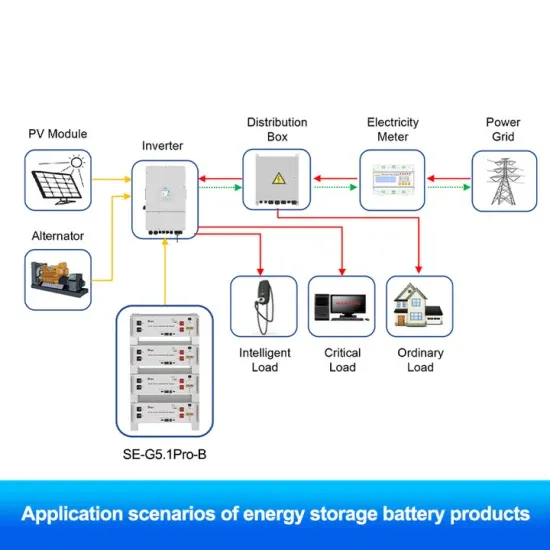

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.