5G Base Station Power Supply System: NextG Power''s Cutting

Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Get a quote

5G Base Station Market Size, Share & Growth Report,

To meet the increasing demand for these capabilities, telecom operators invest heavily in deploying 5G base stations, the backbone of 5G networks,

Get a quote

Ranking of the top 10 manufacturers in the global 5G base station

Samsung ranks 5th in terms of global base station sales, with a market share of only 3%, which is the bottom line. But in the race for 5G commercialization, Samsung is

Get a quote

5G Chip Makers: Four Companies Are Leading the

In June 2017, Analog Devices announced the latest update to its award-winning RadioVerse™ technology and design ecosystem, which simplifies and

Get a quote

News | TrendForce

Chinese and European suppliers of base station equipment are expected to once again account for a global market share of more than 70% in 2021, and the top three suppliers (along with

Get a quote

5G Base Station Antenna in Tower

China Mobile''s 5G Base Station Antenna in Tower, take a look at the details of 5G Base Station Antennas in China Tower, See more Antenna Project Gallery..

Get a quote

Best Practices to Accelerate 5G Base Station Deployment: Your

The 5G massive MIMO base station has arrived and carriers continue to ramp up deployments. The global demand for product with varying frequencies and power levels

Get a quote

5G Base Station Market Size, Share & Growth Report, 2030

To meet the increasing demand for these capabilities, telecom operators invest heavily in deploying 5G base stations, the backbone of 5G networks, facilitating faster data transmission

Get a quote

Global 5G Base Station Market Insights, Forecast to 2029

The global key manufacturers of 5G Base Station include Huawei, Ericsson, ZTE, Nokia, Samsung, and etc. In 2022, the global top five players had a share approximately 95%

Get a quote

5g network manufacturers

Here''s a technical overview of the key components and players involved in the 5G network ecosystem: Radio Access Network (RAN) Equipment Manufacturers: Huawei: A

Get a quote

5G Base Station Companies

Get access to the business profiles of top 10 5G Base Station companies, providing in-depth details on their company overview, key products and services, financials, recent developments

Get a quote

5G RAN Architecture: Nodes And Components

5G RAN Architecture The 5G RAN architecture is composed of multiple nodes and components that work together to provide seamless connectivity to users. These nodes

Get a quote

5G Network Equipment Manufacturers

The 5G next-generation base transceiver station or gNodeB (gNB) connects subscriber user equipment (UE) devices to the mobile network. Many of the gNB throughput improvements

Get a quote

5G Base Station Equipment Market Report 2025,

For detailed insights on the key dynamics influencing the 5G Base Station Equipment market growth and SWOT analysis of the 5G Base Station

Get a quote

Gartner''s Top 10 Global 5G Network Infrastructure

Gartner''s Magic Quadrant for 5G Network Infrastructure for CSPs include 5G market leaders like Ericsson, Samsung, Huawei, as well as networking and

Get a quote

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Get a quote

Top 12 5G Infrastructure Companies in the World

These solutions include 5G radio access products, which are used to build the base stations and antennas that form the backbone of 5G networks. It also offers 5G transport solutions, which

Get a quote

5G Base Station Equipment Market Report 2025, Trends And Size

For detailed insights on the key dynamics influencing the 5G Base Station Equipment market growth and SWOT analysis of the 5G Base Station Equipment industry, request a sample here.

Get a quote

Global 5G Base Station Market 2025 by Manufacturers, Regions,

The core manufacturers in global 5G Base Station market are Huawei, Ericsson, ZTE, Nokia and Samsung, etc, accounting for 92% market share. Huawei is the world''s largest 5G Base

Get a quote

5G Network Equipment Manufacturers: Modem, Base Station,

Explore leading 5G equipment manufacturers for modems, base stations, RAN, and core networks. Discover vendors enhancing network speed and efficiency.

Get a quote

Global 5G Base Station Chips Market 2025

5G Base Station Chips are specialized semiconductor components designed to power the hardware of 5G base stations. These chips handle tasks such as signal processing, data

Get a quote

5G Base Station Equipment Market 2025

3.5 Global 5G Base Station Equipment Price by Manufacturer (2020-2025) 3.6 Top 3 and Top 5 5G Base Station Equipment Companies in Global Market, by Revenue in 2024

Get a quote

Top 10 5G chipsets

Ranging from wireless network infrastructure and base stations to smartphone and IoT device applications, these 5G chipsets promise to simplify the transition to 5G

Get a quote

6 FAQs about [5g base station manufacturer]

What is the global 5G base station market size?

The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a CAGR of 33.5% from 2024 to 2030. The surging demand for high-speed connectivity is a significant factor driving the growth of the 5G base station market.

What is a 5G base station?

5G base stations operate on various frequency bands, including sub-6 GHz and mmWave, to deliver ultra-low latency, high data throughput, and enhanced capacity. They support massive MIMO (Multiple Input Multiple Output) technology, enabling improved coverage and simultaneous connections for a large number of devices.

What are the top 5G manufacturers?

Leading vendors are offering innovative products to enhance network speed, coverage, and efficiency. Explore the top manufacturers shaping the future of 5G, including Altiostar, Cisco Systems, Datang Telecom/Fiberhome, Ericsson, Huawei, Nokia, Qualcomm, Samsung, and ZTE. What is 5G NR?

What is a 5G NR Network?

As defined in 3GPP TS 38.300, the 5G NR network consists of NG RAN (Next Generation Radio Access Network) and 5GC (5G Core Network). As shown, NG-RAN is composed of gNBs (i.e., 5G Base stations) and ng-eNBs (i.e., LTE base stations). The figure above depicts the overall architecture of a 5G NR system and its components.

How 5G technology is transforming connectivity?

5G technology is revolutionizing connectivity, and the manufacturers of 5G equipment are leading this transformation. From modems and base stations to RAN, antenna arrays, and core networks, these companies are providing cutting-edge solutions. Leading vendors are offering innovative products to enhance network speed, coverage, and efficiency.

What is a 5G gnodeb?

The 5G next-generation base transceiver station or gNodeB (gNB) connects subscriber user equipment (UE) devices to the mobile network. Many of the gNB throughput improvements come from multiple input and multiple output (MIMO) antenna systems that improve cellular connection reliability and quality.

Guess what you want to know

-

5g base station manufacturer

5g base station manufacturer

-

Togo 5G base station power equipment manufacturer

Togo 5G base station power equipment manufacturer

-

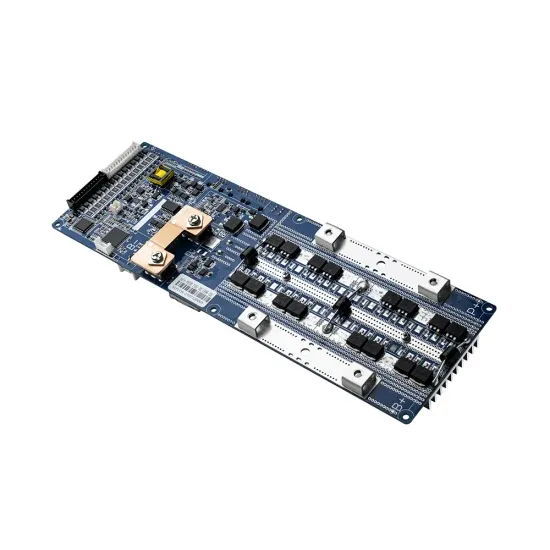

5g base station integrated power supply manufacturer

5g base station integrated power supply manufacturer

-

Vaduz 5G base station photovoltaic power generation system communication cabinet manufacturer

Vaduz 5G base station photovoltaic power generation system communication cabinet manufacturer

-

Peru 5G base station contact

Peru 5G base station contact

-

5g single base station communication capacity

5g single base station communication capacity

-

Ecuador s hybrid energy 5G base station 2MWH

Ecuador s hybrid energy 5G base station 2MWH

-

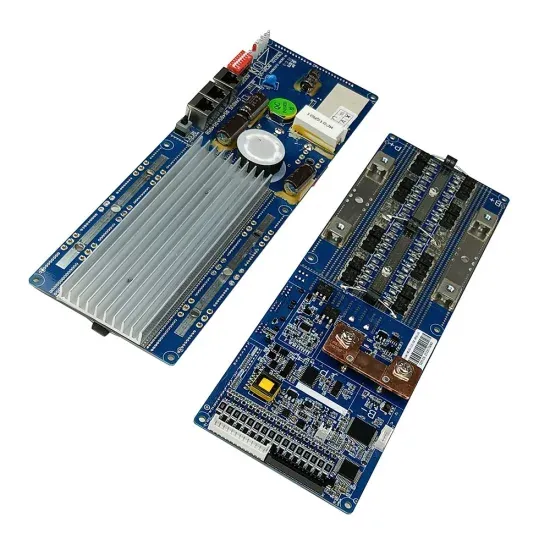

5G base station power supply equipment

5G base station power supply equipment

-

Slovakia 5G communication base station inverter construction

Slovakia 5G communication base station inverter construction

-

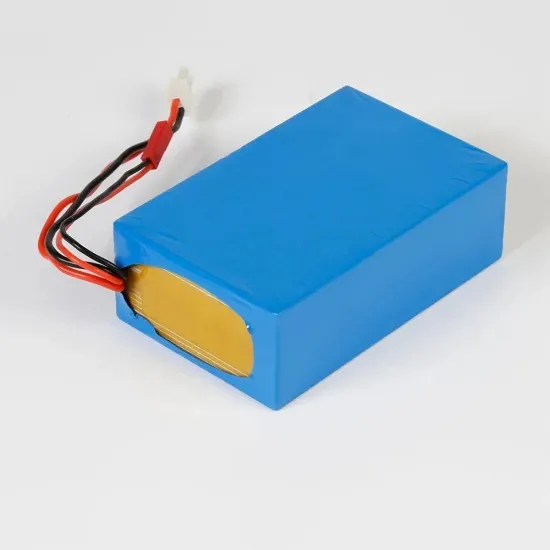

5g base station battery module

5g base station battery module

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.