Global energy storage

The global battery industry has been gaining momentum over the last few years, and investments in battery storage and power grids surpassed 450 billion U.S. dollars in 2024.

Get a quote

Executive summary – Batteries and Secure Energy

Sodium-ion batteries provide less than 10% of EV batteries to 2030 and make up a growing share of the batteries used for energy storage because they use

Get a quote

Is battery storage a good investment opportunity?

vestor appetite, are we simply repeating history? In this report, we take an in-depth look at the fundamentals of the four key revenue streams available to batteries: arbitrage, bal. ncing,

Get a quote

Investment Insights into Energy Storage Power Stations: Cost

11 hours ago· Energy storage power stations have become vital pillars of the renewable energy transition. By storing excess electricity during low-demand periods and releasing it during peak

Get a quote

CHINA''S ACCELERATING GROWTH IN NEW TYPE

In terms of storage types, the dominant advantage of lithium-ion batteries continues to expand, accounting for 97.4% of the new type storage installation. Other types, such as air

Get a quote

China Energy Transition Review 2025

+69% Battery storage investment in China rose 69% from H1 2024 to H1 2025, while grid investment rose 22%. China accounts for 31% of global clean energy investment. 65%

Get a quote

New energy storage shares account for a high proportion

Second, the energy storage operation model of the power supply side under the high proportion of wind power access is established, and the impact of new energy access on This includes

Get a quote

We''re about to see a $1 trillion ''super-cycle'' of investment in

Close to half of all battery storage projects are paired with solar or wind energy projects as part of their symbiotic relationship.

Get a quote

U.S. Grid Energy Storage Factsheet

Electrical Energy Storage (EES) refers to systems that store electricity in a form that can be converted back into electrical energy when needed. 1 Batteries are one of the most common

Get a quote

We''re about to see a $1 trillion ''super-cycle'' of

Close to half of all battery storage projects are paired with solar or wind energy projects as part of their symbiotic relationship.

Get a quote

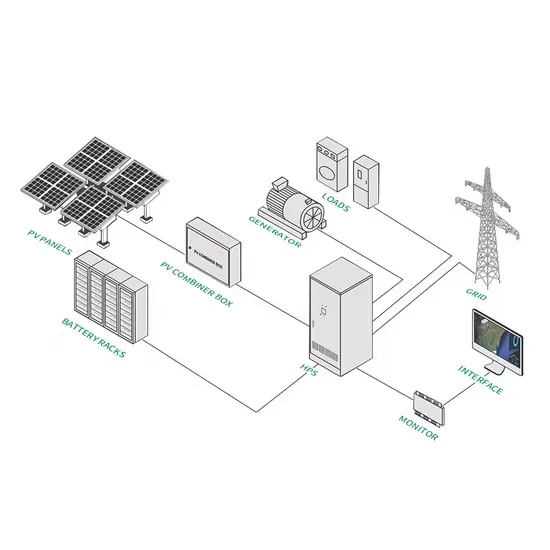

Configuration and operation model for integrated

It is crucial to integrate energy storage devices within wind power and photovoltaic (PV) stations to effectively manage the impact of large-scale

Get a quote

Optimal scheduling strategies for electrochemical

2 PKU-Changsha Institute for Computing and Digital Economy, Changsha, China Introduction: This paper constructs a revenue model for an

Get a quote

Life Cycle Cost-Based Operation Revenue Evaluation of Energy

Case studies based on the actual data of the Jinyun water-photovoltaic renewable energy aggregation station with energy storage equipment in Lishui City of China are

Get a quote

Energy Storage Grand Challenge Energy Storage Market

The existing capacity in stationary energy storage is dominated by pumped-storage hydropower (PSH), but because of decreasing prices, new projects are generally lithium-ion (Li-ion) batteries.

Get a quote

Life Cycle Cost-Based Operation Revenue Evaluation of Energy Storage

Case studies based on the actual data of the Jinyun water-photovoltaic renewable energy aggregation station with energy storage equipment in Lishui City of China are

Get a quote

Executive summary – Batteries and Secure Energy Transitions –

Sodium-ion batteries provide less than 10% of EV batteries to 2030 and make up a growing share of the batteries used for energy storage because they use less expensive materials and do not

Get a quote

How much does a large energy storage power station

Cost of a large energy storage power station varies considerably based on multiple factors, including 1. technology employed, 2. geographical

Get a quote

Capital Cost and Performance Characteristics for Utility

Findings Table 1 summarizes updated cost estimates for reference case utility–scale generating technologies specifically two powered by coal, five by natural gas, three by solar energy and

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

The same is true for solar power and related next-gen battery technology. Energy storage systems are increasingly in demand to increase the effectiveness of solar power

Get a quote

Battery Storage in the United States: An Update on Market

Lower battery costs, in addition to lessons learned from previous storage deployment in regions with market rules or state requirements, may have led to increased investment of

Get a quote

Typical MW-level battery-energy-storage power station.

With the large-scale access of renewable energy, the randomness, fluctuation and intermittency of renewable energy have great influence on the stable

Get a quote

Investment trends in grid-scale battery storage

Spending on grid-scale batteries rose by more than 60%, driven by the push for investments in renewables. The costs of battery storage systems

Get a quote

Investment trends in grid-scale battery storage

Spending on grid-scale batteries rose by more than 60%, driven by the push for investments in renewables. The costs of battery storage systems reportedly continued to

Get a quote

Energy Storage Investments – Publications

As investment in renewable energy generation continues to rise to match increasing demand so too does investment, and the opportunity to invest, in energy storage. Estimates

Get a quote

The Energy Storage Market in Germany

This makes the use of new storage technologies and smart grids imperative. Energy storage systems – from small and large-scale batteries to power-to-gas technologies – will play a

Get a quote

6 FAQs about [Batteries in energy storage power stations account for the proportion of investment]

How much energy does a battery storage system use?

The average for the long-duration battery storage systems was 21.2 MWh, between three and five times more than the average energy capacity of short- and medium-duration battery storage systems. Table 1. Sample characteristics of capital cost estimates for large-scale battery storage by duration (2013–2019)

Are battery storage projects a symbiotic relationship?

Close to half of all battery storage projects are paired with solar or wind energy projects as part of their symbiotic relationship. “Without batteries it would be mayhem,” said Izzet Bensusan, founder and CEO of the Captona energy transition investment firm. “The utilities are realizing that without batteries they cannot manage the grid.

Is battery energy storage a savior?

Today, technology advances and dramatic cost decreases combine to set up battery energy storage as the savior for both renewables and the overarching electric grid as power demand soars and Congress rapidly phases out tax credits for wind and solar energy.

What is the average power capacity of a battery storage system?

For costs reported between 2013 and 2019, short-duration battery storage systems had an average power capacity of 12.4 MW, medium-duration systems had 6.4 MW, and long-duration battery storage systems had 4.7 MW. The average energy capacity for the short- and medium-duration battery storage systems were 4.7 MWh and 6.6 MWh, respectively.

When will large-scale battery energy storage systems come online?

Most large-scale battery energy storage systems we expect to come online in the United States over the next three years are to be built at power plants that also produce electricity from solar photovoltaics, a change in trend from recent years.

How many GW of battery storage capacity are there in the world?

Strong growth occurred for utility-scale battery projects, behind-the-meter batteries, mini-grids and solar home systems for electricity access, adding a total of 42 GW of battery storage capacity globally.

Guess what you want to know

-

Dangerous factors of energy storage batteries in power stations

Dangerous factors of energy storage batteries in power stations

-

Investment in energy storage power stations exceeding 10 million

Investment in energy storage power stations exceeding 10 million

-

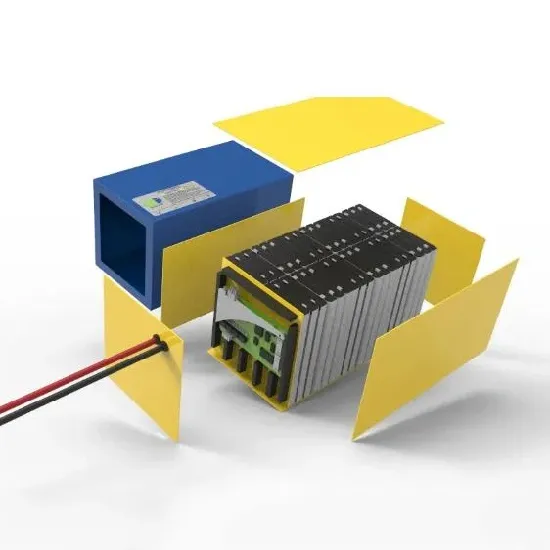

How many types of batteries are there in energy storage power stations

How many types of batteries are there in energy storage power stations

-

Energy storage batteries as energy storage power stations

Energy storage batteries as energy storage power stations

-

Investment prospects for energy storage power stations

Investment prospects for energy storage power stations

-

Investment scale of energy storage power stations

Investment scale of energy storage power stations

-

Do photovoltaic power stations have energy storage batteries

Do photovoltaic power stations have energy storage batteries

-

What are the gravity energy storage power stations in Vietnam

What are the gravity energy storage power stations in Vietnam

-

What are the smart energy storage power stations in Nicaragua

What are the smart energy storage power stations in Nicaragua

-

What are the chemical energy storage power stations in Canada

What are the chemical energy storage power stations in Canada

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.