Navigating the Final IRS Regulations for Investment Tax Credits:

Energy storage technology qualifies for the ITC if Section 48 requirements are met, even when co-located with facilities eligible for other tax credits. Prevailing wage and

Get a quote

What are the eligibility criteria for energy storage tax credits

To be eligible for energy storage tax credits, such as the Residential Clean Energy Credit, the following criteria must be met: Eligibility Criteria for Battery Storage Tax Credits

Get a quote

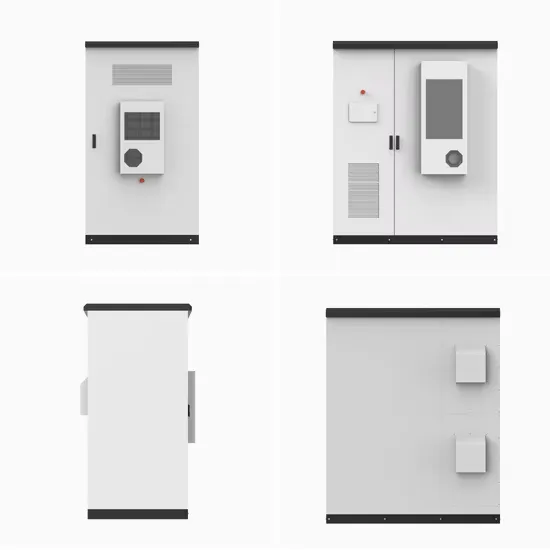

How much electricity does the energy storage cabinet store?

1. Energy storage cabinets are devices that can store electricity for later use, with varying capacities depending on the technology and design used. The amount of electricity

Get a quote

Battery Storage Technology Tax Credit

Both principal residences and second homes qualify. Rentals do not qualify. This system must be installed in connection with a dwelling unit located in the United States and used as a

Get a quote

What are the eligibility requirements for the federal tax

To be eligible for the federal tax credit for energy storage systems, such as battery storage technology, the following requirements must be met:

Get a quote

Federal 25D battery storage tax credit

Battery storage technology must have a capacity of 3 kilowatt-hours or greater. Source: Internal Revenue Service. The good news is that if you already used

Get a quote

Federal 25D battery storage tax credit

Battery storage technology must have a capacity of 3 kilowatt-hours or greater. Source: Internal Revenue Service. The good news is that if you already used the 25D credit during a prior year,

Get a quote

Grid-Scale Battery Storage: Frequently Asked Questions

Studies and real-world experience have demonstrated that interconnected power systems can safely and reliably integrate high levels of renewable energy from variable renewable energy

Get a quote

IRS Issues Updated Energy Efficient Home Improvement Credit

The Inflation Reduction Act of 2022 (IRA) contained significant changes to both the Energy Efficient Home Improvement Credit under Internal Revenue Code (IRC) Section 25C

Get a quote

New and Used Clean Vehicle Tax Credits

. Summary of Tax Credits for New and Used Clean Vehicles and Charging Equipment Three new tax credits are available to individual purchasers of

Get a quote

Electric Vehicle Tax Credits | Department of Energy

Tax credits are available for eligible new and used electric vehicles, and for home chargers and associated energy storage. Find out the requirements to qualify for these tax credits.

Get a quote

Instructions for Form 5695 (2024)

If the qualified battery storage technology has a capacity of 3 kilowatt hours or greater, then check the "Yes" box, enter the amounts you paid for qualified battery storage technology on line 5b.

Get a quote

Energy Storage Cabinet Support Requirements: What You Need

Who Cares About Battery Cabinet Support? (Spoiler: Everyone) Let''s start with a reality check: if you''re installing energy storage cabinets, you''re probably not daydreaming about load-bearing

Get a quote

P&FM Storage Licence

Petroleum and Flammable Material (P&FM) storage are considered high risk activities as they pose a threat to life and property in the event of fire. Hence application for their issuance is

Get a quote

Navigating the Final IRS Regulations for Investment

Given the complexity of these regulations, project stakeholders should work closely with tax and energy specialists to navigate compliance

Get a quote

How much does the energy storage grid cabinet cost?

Ultimately, an energy storage grid cabinet serves as a long-term investment with both financial benefits and pivotal contributions to a

Get a quote

Training Requirements for Qualified Electrical Workers

NFPA 70E, Standard for Electrical Safety in the Workplace, and OSHA 29 CFR 1910.332 define and state the requirements for determining

Get a quote

Powerwall Tax Credit Qualification Statement

Qualified battery storage technology is defined as an expenditure for battery storage technology which is installed in connection with a dwelling unit located in the United States and used as a

Get a quote

Whole home battery backup qualifies for a 30% tax

The term "qualified battery storage technology expenditure" means an expenditure for battery storage technology which— (A) is installed in

Get a quote

NFPA 70E Battery and Battery Room Requirements | NFPA

It is a requirement to have all the documentation in place prior to authorized personnel entering a battery room to perform a specific work task on a battery system under

Get a quote

Understanding the Battery Storage Technology Tax

The outcome is potentially twofold: eligibility for the tax credit for both solar panels and battery storage, offering a remarkable synergy of

Get a quote

Energy Efficient Home Improvement Credit: Save Money While

Maximize your savings with the Energy Efficient Home Improvement Credit! Upgrade to energy-efficient systems, qualify for tax credits, and enjoy lower utility bills.

Get a quote

Financing standalone battery storage: the Inflation Reduction Act

In order for a battery storage system to be eligible for the ITC, the system must be at least 5 kWh in size and construction must commence by the end of calendar year 2024. Moreover, the ITC

Get a quote

Understanding the Battery Storage Technology Tax Credit

The outcome is potentially twofold: eligibility for the tax credit for both solar panels and battery storage, offering a remarkable synergy of advantages encompassing heightened energy

Get a quote

What are the eligibility requirements for the federal tax credit for

To be eligible for the federal tax credit for energy storage systems, such as battery storage technology, the following requirements must be met: Capacity Requirement: The

Get a quote

Navigating the Final IRS Regulations for Investment

Energy storage technology qualifies for the ITC if Section 48 requirements are met, even when co-located with facilities eligible for other tax

Get a quote

Frequently asked questions about energy efficient home

A taxpayer claiming the credit for qualified fuel cell property expenditures must have installed such property on or in connection with a home located in the United States and used as a principal

Get a quote

Financing standalone battery storage: the Inflation

In order for a battery storage system to be eligible for the ITC, the system must be at least 5 kWh in size and construction must commence by the end of

Get a quote

6 FAQs about [How much does a new energy battery cabinet need to be considered qualified ]

What are qualified battery storage technology costs?

Qualified battery storage technology costs. Qualified battery storage technology costs are costs for battery storage technology that is installed in connection with your home located in the United States and has a capacity of at least 3 kilowatt hours. Qualified fuel cell property costs.

How do I qualify for a battery storage credit?

To qualify for the credit, the qualified battery storage technology must have a capacity of at least 3 kilowatt hours. If the qualified battery storage technology has a capacity of 3 kilowatt hours or greater, then check the “Yes” box, enter the amounts you paid for qualified battery storage technology on line 5b.

How do I qualify for a home battery tax credit?

To qualify for this tax credit, the following conditions need to be met: Your home needs to be in the United States, and it should be where you live. The battery system must have a capacity of at least 3 kilowatt hours. Starting from 2023, this 3-kilowatt-hour requirement for the battery capacity becomes important.

How many kilowatts does a home battery need?

Your home needs to be in the United States, and it should be where you live. The battery system must have a capacity of at least 3 kilowatt hours. Starting from 2023, this 3-kilowatt-hour requirement for the battery capacity becomes important. Most battery setups, though, are usually larger than this – often around 10 kilowatt hours or even more.

Can I include battery storage technology costs on line 5b?

If the qualified battery storage technology has a capacity of 3 kilowatt hours or greater, then check the “Yes” box, enter the amounts you paid for qualified battery storage technology on line 5b. If you check the “No” box, you can't include any battery storage technology costs on line 5b. See Qualified battery storage technology costs, earlier.

Is battery storage getting a tax credit?

The moment we've all been waiting for has finally arrived. Brace yourself for some exciting news: battery storage is stepping into the spotlight, basking in the glow of a well-deserved 30% federal tax credit. It's standing shoulder to shoulder with its renewable energy companions – solar power, wind energy, geothermal heat pumps, and fuel cells.

Guess what you want to know

-

How much does a new energy battery cabinet cost

How much does a new energy battery cabinet cost

-

How many volts does the new energy battery cabinet come out with

How many volts does the new energy battery cabinet come out with

-

Is the new energy battery cabinet charged How to connect it

Is the new energy battery cabinet charged How to connect it

-

Armenia Battery New Energy Battery Cabinet

Armenia Battery New Energy Battery Cabinet

-

The whole process of new energy battery cabinet

The whole process of new energy battery cabinet

-

Dangerous Goods New Energy Battery Cabinet

Dangerous Goods New Energy Battery Cabinet

-

New Energy Battery Cabinet Company

New Energy Battery Cabinet Company

-

Battery cabinet new energy processing

Battery cabinet new energy processing

-

New Energy Battery Cabinet Attenuation Standard

New Energy Battery Cabinet Attenuation Standard

-

Danish new energy battery cabinet communication power supply professional

Danish new energy battery cabinet communication power supply professional

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.