Federal Solar Tax Credit Resources | Department of Energy

Developed by the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO), these guides provide overviews of the federal solar investment tax credit,

Get a quote

How to claim a residential clean energy tax credit

Use these steps for claiming a residential clean energy tax credits. Step 1: Check eligibility Make sure the property on which you are installing the energy property is eligible:

Get a quote

How to Get a Solar Tax Credit While You Still Can

What Is the Solar Tax Credit? If you install solar energy equipment in your residence before the end of 2025, you''re entitled to a nonrefundable credit off your federal

Get a quote

Solar Energy Systems Tax Credit

Photovoltaic systems must provide electricity for the residence, and must meet applicable fire and electrical code requirements. The home served by the system does not have to be the

Get a quote

Federal tax credits for home solar and EVs will disappear soon :

Federal tax credits for rooftop solar, heat pumps and other energy-efficient technologies are going away at the end of the year. Here''s what consumers should know.

Get a quote

April 2025 Solar Policy Updates: Tariffs, Clean Energy Tax

Stay updated on the latest U.S. solar policy changes, including new tariffs, clean energy tax credits, and EPA rollbacks. Learn how these shifts impact the solar industry in April

Get a quote

Federal Solar Tax Credit Resources | Department of

Developed by the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO), these guides provide overviews of the federal

Get a quote

Solar Tax Credit Ends 2025: Are Solar Panels Still Worth It?

The 30% solar tax credit ends in 2025. Will solar panels still save you money? Learn about the new deadlines, how to calculate your ROI, and top states for solar without the credit.

Get a quote

Federal solar tax credit in 2025: How does it work?

The federal solar tax credit, commonly referred to as the investment tax credit or ITC, allows you to claim 30% of the cost of your solar panel

Get a quote

Residential Clean Energy Credit

If you invest in renewable energy for your home such as solar, wind, geothermal, fuel cells or battery storage technology, you may qualify for an annual residential clean energy tax

Get a quote

Solar Incentives by State (2025) | ConsumerAffairs®

Curious what solar incentives you can get? Explore tax credits, rebates and more by state. Learn about net metering and other financial incentives.

Get a quote

Solar Tax Credit By State – Forbes Home

Learn more about the solar tax credit by state, and how you can benefit from this program along with other ways to save on solar through 2032 and beyond.

Get a quote

Trump and the Fate of the 30% Solar Tax Credit in 2025

Study after study— including this 2025 analysis by solar —has shown that solar panels increase home value. The added value varies by location and other factors, and is not

Get a quote

Under Trump presidency, solar tax credits could be at

A contractor installs a solar panel on the roof of a home. Uncertainty over the future of a 30% federal tax credit has some homeowners

Get a quote

How to Get a Solar Tax Credit While You Still Can

What Is the Solar Tax Credit? If you install solar energy equipment in your residence before the end of 2025, you''re entitled to a nonrefundable

Get a quote

Solar stocks plunge as Republican tax bill worse than feared for

Solar stocks are plunging as the House Republican tax bill terminates key clean energy credits. The legislation is "disastrous" for the rooftop solar industry, according to

Get a quote

Federal solar tax credit in 2025: How does it work?

The federal solar tax credit, commonly referred to as the investment tax credit or ITC, allows you to claim 30% of the cost of your solar panel system as a credit to your federal

Get a quote

Solar Panel Depreciation Methods and Tax Implications

Explore how different solar panel depreciation methods impact tax benefits and financial planning for sustainable energy investments.

Get a quote

6 FAQs about [US solar panel tax]

Do solar panels qualify for a tax credit?

Under the new tax credit timeline, solar panel systems installed by December 31, 2025, will still qualify for the full 30% credit. But systems installed after that date wouldn’t qualify for any tax credit at all. The federal solar tax credit is valuable because it's a dollar-for-dollar reduction of your federal tax bill.

Are solar panels tax deductible?

Readers interested in installing solar products should use their best judgment and seek advice from a licensed tax professional. In 2025, the federal Investment Tax Credit (ITC) allows homeowners to claim 30% of their solar panel system costs as a tax credit on their federal taxes.

Will solar panels be tax deductible in 2025?

In 2025, the federal Investment Tax Credit (ITC) allows homeowners to claim 30% of their solar panel system costs as a tax credit on their federal taxes. Starting January 1, 2026, the residential solar tax credit will disappear completely.

How does the solar tax credit affect residential solar?

Here’s is how this law impacts residential solar: The 30% solar tax credit claimed by homeowners (25D) would be terminated at midnight on December 31, 2025. Homeowners who have their systems installed before the end of the year can still claim this credit against their federal tax liability.

When did the solar panel tax credit start?

The solar panel tax credit actually originated during the oil crisis in 1978. It was then brought back in 2005 and, with some tweaks and changes, has persisted ever since. It’s often referred to as the “Solar Investment Tax Credit” or ITC for short.

Do you have to own a solar system to get tax credit?

You must own your solar energy system to take advantage of the ITC—if you signed a solar lease or PPA, you aren't eligible for the 30% tax credit. Homeowners who want to claim the tax credit before it expires should get quotes now. What is the federal solar investment tax credit?

Guess what you want to know

-

Photovoltaic module solar panel corrosion

Photovoltaic module solar panel corrosion

-

Photovoltaic panels to solar panel equipment

Photovoltaic panels to solar panel equipment

-

Tianjin Which solar panel is best in Zimbabwe

Tianjin Which solar panel is best in Zimbabwe

-

Tunisian solar panel company

Tunisian solar panel company

-

18v 10 watt solar panel

18v 10 watt solar panel

-

550W small solar panel

550W small solar panel

-

30 watt 6v solar panel

30 watt 6v solar panel

-

Kiribati Solar Panel Group

Kiribati Solar Panel Group

-

Sudan solar panel photovoltaic panel factory

Sudan solar panel photovoltaic panel factory

-

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

Industrial & Commercial Energy Storage Market Growth

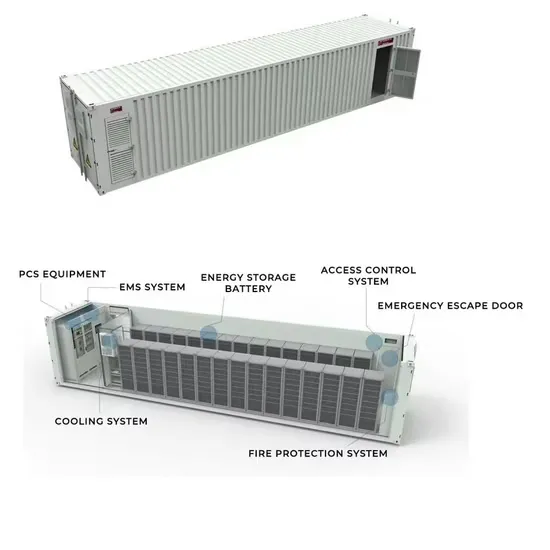

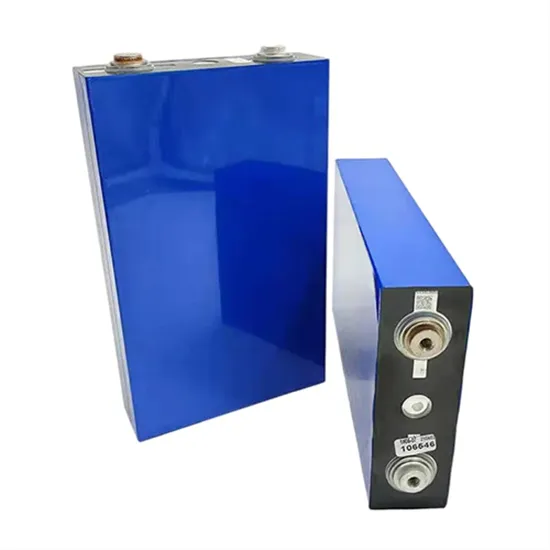

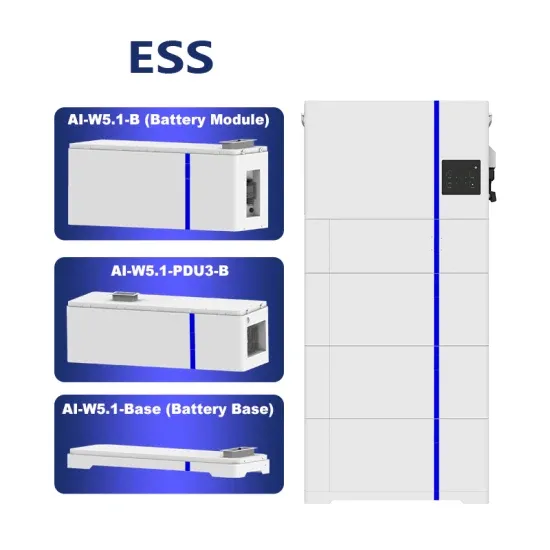

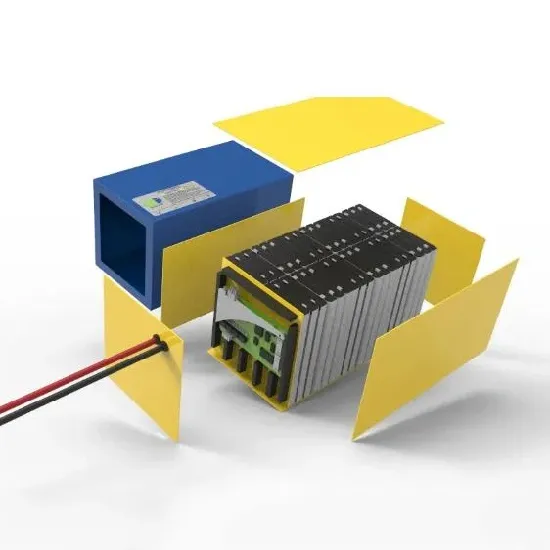

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.