Mutual Funding Energy Morgan Stanley Drives

The partnership will focus on investing in solar and wind energy projects, as well as energy storage and smart grid technologies. Morgan Stanley''s expertise in

Get a quote

What funds have energy storage? | NenPower

Numerous asset management firms have created specific funds focused entirely on clean energy, featuring energy storage as a pivotal component to ensure long-term value

Get a quote

FSENX – Fidelity Select Energy Portfolio Fund Stock Price

FSENX - Fidelity Select Energy Portfolio - Review the FSENX stock price, growth, performance, sustainability and more to help you make the best investments.

Get a quote

What are the funds that invest in energy storage?

Energy storage represents a crucial component in the broader energy ecosystem, enabling the integration of variable renewable energy

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Its so-called "energy servers" are deployed in more than 1,000 locations across nine countries, providing critical backup power for businesses, essential service providers like

Get a quote

Exclusive: CPP Investments on investing in

In an exclusive interview with Power Technology, Bill Rogers, head of Sustainable Energies at the Canada Pension Plan''s (CPP) investment

Get a quote

Which funds include energy storage? | NenPower

To capitalize on this trend, numerous funds have pivoted their investment strategies to encompass energy storage, seeing it as an essential infrastructure element

Get a quote

Fifteen Green Investment Trusts: Renewables, Energy Storage,

Below are a list of 15 investment trusts who could be considered green or sustainable investments. There are a mixture of different portfolio types available. Some focus solely on

Get a quote

What funds to buy for power storage | NenPower

Investment in power storage can yield favorable returns because the sector stands on the cusp of transformative changes. The diversification within the energy portfolio offers

Get a quote

3 uranium ETFs that pack a nuclear punch

Uranium prices are positively radiant this year and have reclaimed prices last seen in 2014. These uranium ETFs can help you harness this power.

Get a quote

What are the funds that invest in energy storage? | NenPower

Energy storage represents a crucial component in the broader energy ecosystem, enabling the integration of variable renewable energy sources, such as solar and wind. A

Get a quote

Which funds hold photovoltaic and energy storage | NenPower

Funds dedicated to solar power and energy storage exemplify this targeted investment style, focusing exclusively on companies excelling in these sectors. Such

Get a quote

Energy Investments: Approach, Leadership & Holdings | Morgan

Understanding Energy Mutual Funds Energy mutual funds invest primarily in companies operating in the energy industry. This may include traditional oil and gas

Get a quote

Which funds are in the energy storage sector? | NenPower

Global commitments to reducing carbon emissions and enhancing sustainability drive considerable investment into renewable energy solutions, including energy storage

Get a quote

Does Power Mutual Investment Have Energy Storage Exploring

Summary: As renewable energy adoption accelerates, power mutual investment portfolios increasingly integrate energy storage solutions. This article explores how energy storage

Get a quote

Which funds should I buy for new energy storage? | NenPower

Investment in new energy storage offers significant potential due to the ongoing transition to renewable energy sources and technological advancements in storage solutions.

Get a quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Vanguard Energy Fund (VGENX)

See Vanguard Energy Fund (VGENX) mutual fund ratings from all the top fund analysts in one place. See Vanguard Energy Fund performance, holdings, fees, risk and other data from

Get a quote

Morgan Stanley Invests $82M in Plus Power''s 90 MW

Plus Power has secured an $82 million tax equity investment from Morgan Stanley for the 90 MW/360 MWh Superstition energy storage facility in

Get a quote

European energy storage: a new multi-billion-dollar asset class

What opportunities does energy storage offer for investors? With energy storage, there''s a new and interesting asset class emerging, and the business model is fundamentally

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

Its so-called "energy servers" are deployed in more than 1,000 locations across nine countries, providing critical backup power for

Get a quote

UBS Asset Management to launch innovative energy

UBS Asset Management establishes new infrastructure energy storage team with three new hires New investment strategy further expands firm''s sustainable

Get a quote

Guess what you want to know

-

Energy storage power station investment entities

Energy storage power station investment entities

-

New Directions for Energy Storage Power Station Investment

New Directions for Energy Storage Power Station Investment

-

Batteries in energy storage power stations account for the proportion of investment

Batteries in energy storage power stations account for the proportion of investment

-

European Construction Investment Energy Storage Power Station

European Construction Investment Energy Storage Power Station

-

Investment scale of energy storage power stations

Investment scale of energy storage power stations

-

Investment in energy storage power stations exceeding 10 million

Investment in energy storage power stations exceeding 10 million

-

Total investment in Senegal energy storage power station

Total investment in Senegal energy storage power station

-

Russia Construction Investment Energy Storage Power Station

Russia Construction Investment Energy Storage Power Station

-

Uganda s investment in energy storage power station projects

Uganda s investment in energy storage power station projects

-

Investment returns of wind power with energy storage

Investment returns of wind power with energy storage

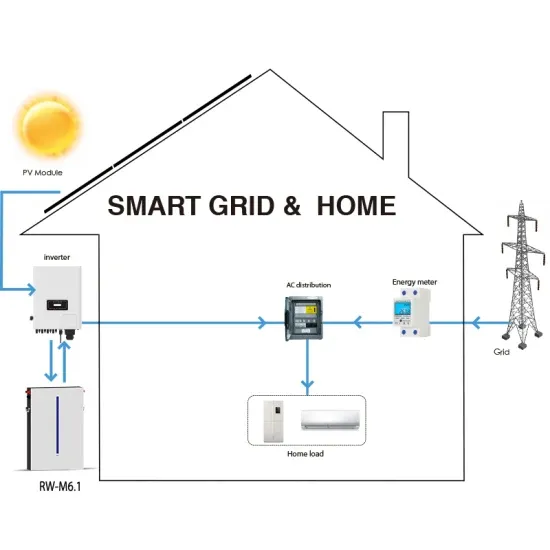

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

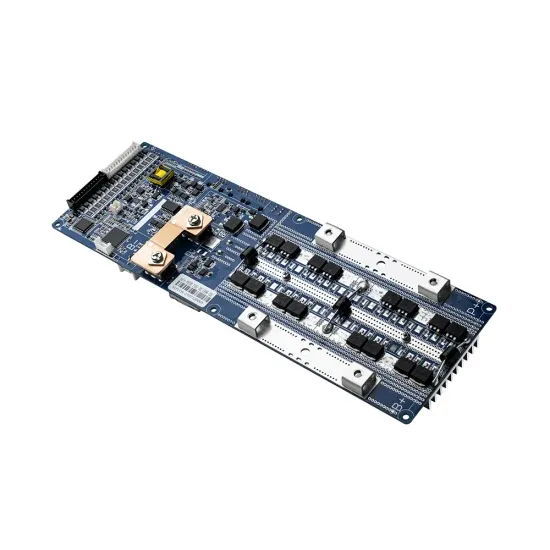

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.