6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get a quote

Introduction of industrial and commercial energy

The profit model of industrial and commercial energy storage is peak-valley arbitrage, that is, a low electricity price is used to charge in the

Get a quote

Commercial & Industrial Energy Storage Project Applications and

The application scenarios and revenue models for commercial and industrial (C&I) energy storage projects are diverse, with different scenarios suited to different profit strategies.

Get a quote

Five revenue models for industrial and commercial energy

1. Owner Self-Investment Model. The energy storage owner''''s self-investment model refers to a model in which enterprises or individuals purchase, own and operate energy storage systems

Get a quote

Profit analysis of industrial and commercial energy storage

The profit model of industrial and commercial energy storage is peak-valley arbitrage, that is, a low electricity price is used to charge in the trough of electricity consumption, and discharge in

Get a quote

Three business models for industrial and commercial energy storage

In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management contracts, and financial leasing. We''ll discuss

Get a quote

Energy Storage Industry Trends: C&I Energy Storage Market

In the future, GSL Energy will continue to focus on industrial and commercial energy storage solutions, promote global energy transformation, and help enterprises realize

Get a quote

A study on the energy storage scenarios design and the business model

Therefore, this paper focuses on the energy storage scenarios for a big data industrial park and studies the energy storage capacity allocation plan and business model of

Get a quote

Three business models for industrial and commercial energy storage

In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management contracts, and financial

Get a quote

Profit analysis of industrial energy storage

Journal of Energy Storage Wang et al. [28]develop a household PV energy storage configuration optimization model with annual net profit as the optimization objective for various applications

Get a quote

industrial energy storage profit calculation formula

Analysis and Comparison for The Profit Model of Energy Storage Therefore, this article analyzes three common profit models that are identified when EES participates in peak-valley

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· Altmetric Review Article A comprehensive review of large-scale energy storage participating in electricity market transactions: Profit model and clearing mechanism

Get a quote

Three Investment Models for Industrial and Commercial Battery Energy

In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a key role in today''s energy

Get a quote

Introduction of industrial and commercial energy storage and

The profit model of industrial and commercial energy storage is peak-valley arbitrage, that is, a low electricity price is used to charge in the trough of electricity

Get a quote

Three Investment Models for Industrial and

In this article, we''ll take a closer look at three different commercial and industrial battery energy storage investment models and how they play a

Get a quote

Profit analysis of industrial and commercial energy storage

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Get a quote

Introduction of industrial and commercial energy storage and

Industrial and commercial energy storage systems using optical storage all-in-one machines Industrial and commercial energy storage business model The profit model of industrial and

Get a quote

Commercial & Industrial Energy Storage Project

The application scenarios and revenue models for commercial and industrial (C&I) energy storage projects are diverse, with different scenarios suited to

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to char-acterize business models of energy storage and systematically differentiate in-vestment opportunities.

Get a quote

profit and loss of industrial and commercial energy storage

Analysis and Comparison for The Profit Model of Energy Storage The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators

Get a quote

Energy Storage Business Model Analysis: Key Trends, Revenue

Our analysis shows three primary audiences driving demand: Take California''s duck curve phenomenon – where solar overproduction meets evening demand spikes. Storage systems

Get a quote

The new economics of energy storage | McKinsey

The model shows that it is already profitable to provide energy-storage solutions to a subset of commercial customers in each of the four

Get a quote

Energy storage in China: Development progress and business model

Even though several reviews of energy storage technologies have been published, there are still some gaps that need to be filled, including: a) the development of energy storage

Get a quote

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get a quote

Business Models and Profitability of Energy Storage

Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Get a quote

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get a quote

Profit analysis of new energy storage sector

model found that one company''s products were more economic than the other''s in 86 percent of the sites because of the product''s ability to charge and discharge more quickly, with an

Get a quote

Guess what you want to know

-

Profit model of station-side energy storage power station

Profit model of station-side energy storage power station

-

Burkina Faso Industrial Energy Storage Cabinet Model

Burkina Faso Industrial Energy Storage Cabinet Model

-

Profit model of new energy storage

Profit model of new energy storage

-

Equatorial Guinea Industrial Energy Storage Cabinet Model Query

Equatorial Guinea Industrial Energy Storage Cabinet Model Query

-

Side energy storage new energy profit model

Side energy storage new energy profit model

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

-

Global power generation side energy storage profit model

Global power generation side energy storage profit model

-

Mauritius Industrial Energy Storage Cabinet Model Query

Mauritius Industrial Energy Storage Cabinet Model Query

-

Profit model and cost structure of energy storage power stations

Profit model and cost structure of energy storage power stations

-

Industrial Energy Storage Emergency Power Supply

Industrial Energy Storage Emergency Power Supply

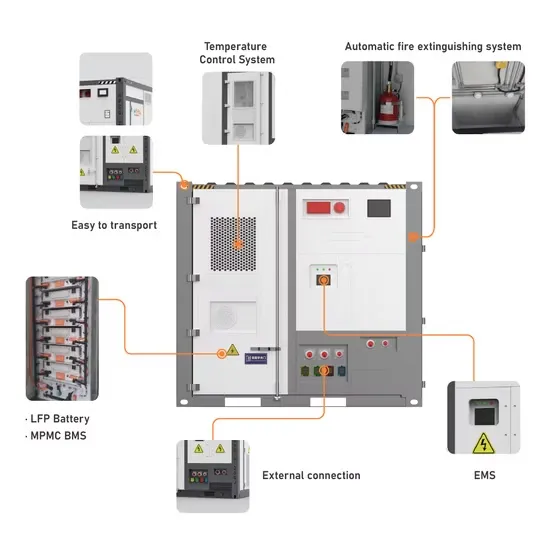

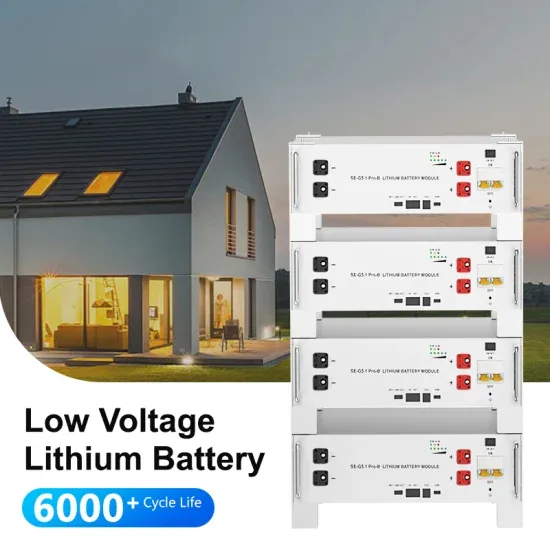

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.